Enrique Medina

Enrique Medina

Two years ago, we explained how surprising the unconditional clearance in Phase 1 of the WhatsApp acquisition by Facebook was. Our first shock came from the fact that a concentration affecting a combined amount of 1,7 billion users worldwide and 300 million users in Europe could have not even been analyzed by the DGCOMP; in our view, this evidenced that new thresholds were needed for an accurate application of competition law to the digital economy, as we had repeatedly stated. Phase 1 clearance was also surprising in light of the interesting debates that the merger opened and the need to analyze in depth its effects on competition.

Two years ago, we explained how surprising the unconditional clearance in Phase 1 of the WhatsApp acquisition by Facebook was. Our first shock came from the fact that a concentration affecting a combined amount of 1,7 billion users worldwide and 300 million users in Europe could have not even been analyzed by the DGCOMP; in our view, this evidenced that new thresholds were needed for an accurate application of competition law to the digital economy, as we had repeatedly stated. Phase 1 clearance was also surprising in light of the interesting debates that the merger opened and the need to analyze in depth its effects on competition.

As for the first aspect, the impact of this merger has meant a highly positive advance in merger control, i.e., the opening of a debate in order to modify the Merger Control Regulation’s thresholds. Indeed, Facebook/WhatsApp case raised the alarm about key cases in the digital ecosystem which could be escaping from Commission’s scrutiny. Mergers of digital companies not having high turnovers (due to the provision of free services) are not captured by the EU Merger Control Regulation, whose thresholds are based just on turnover. Facebook/WhatsApp was reviewed by the Commission due to the EU referral system and because it was captured by three national merger control regimes (Cyprus, Spain and UK– which it is important because after Brexit and a current reform in the Cyprus regime it is very likely that similar mergers will not be caught by these national systems anymore and then no possible referral to the Commission will exist). As far as we know, nowadays the Commission is working on several alternatives (transaction value, users, data, etc.) to propose a review of the merger control thresholds. Telefónica celebrates this initiative of review because, once the reform will be accomplished, there will be a level playing field in EU merger control independently of companies’ business models.

As for the competitive debates opened by this merger, in our 2014 post, we detailed several anticompetitive effects we could foresee coming from that merger. These effects need to be revisited today after WhatsApp’s announce of the sharing of its users’ personal data with Facebook (and its group of companies). As we said two years ago, Facebook position in the online advertising market would be highly reinforced thanks to WhatsApp acquisition, because it allowed Facebook access to approximately 600 million users personal data (around 1 billion today!). This data concentration in a market with so strong network effects and no regulation to nuance them should have been at least analyzed in depth. Facebook is the second player in the worldwide online advertising market and could even enjoy a dominant position in hypothetical narrower relevant markets, such as mobile online advertising (where Facebook has around 44% of market share) or online advertising in social networks (where it has around 65% of market share) -reasonable definitions, due to the extraordinary capacity of targeting that online advertising offers in social networks-, but the Commission preferred to leave the market definition open ( and then without any analysis under such definitions). Other possible relevant markets such as on-line gaming, e-commerce or data-related markets were not analyzed either.

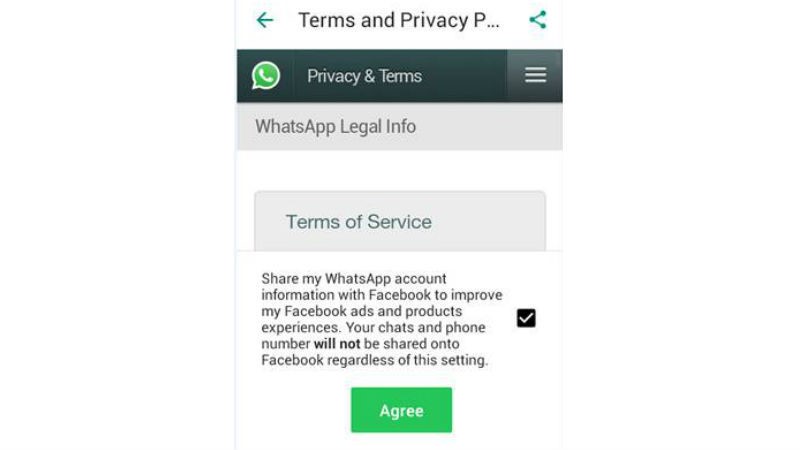

The Commission, in its clearance decision, stated that it did not considered likely that WhatsApp would become a source of user data valuable for advertising purposes because: i) The ability to do it was doubtful: it would require to change WhatsApp privacy policy and to match each WhatsApp user’s profile with her/his Facebook profile; ii) the merged entity will not have incentives to do so due to possible switching by users.

Last 25th August the around 1 billion clients worldwide of WhatsApp received a message explaining that WhatsApp had changed its privacy policy and that users’ data could be shared with Facebook and other Facebook group’s companies from that moment on.

Therefore, contrary to Commission’s believes, WhatsApp has become a source of users’ data (a unique worldwide data set of more than 1 billion users!) for Facebook. And this development – as well as its implications from a competitive perspective, not from privacy perspective- has not been properly analyzed by the Commission because they thought it was not going to happen.

Two years ago, it was maybe too early to understand the role of data into the digital economy, to understand that data is not just an asset to be used to compete in the online advertising market. The Commission still focused on the monetary transactions only and disregarded the non-monetary exchanges produced in the digital environment, where free services are provided against “data compensations”. These new business models give raise to new forms of analysis where data is considered not just an asset but also a sui generis currency.

In that sense, the Commission also failed in properly analyzing data-related markets, which are nowadays much more complex than the simple provision of online advertising. Providers of digital services use data also to improve their services and, sometimes to monetize them in other ways (data aggregation, e-commerce, etc.) or even just to design privacy products. There is a whole industry around data and its monetization which is pursued not just through online advertising. Moreover, there are several and complex competitive processes around data and privacy, which will force cCompetition Law to include them into the analysis. This is the kind of analysis which other competition authorities, as the German and the French ones – which have recently published a joint paper [http://www.bundeskartellamt.de/SharedDocs/Publikation/DE/Berichte/Big%20Data%20Papier.html]- are starting to develop; the kind of analysis we expect from the European Commission in following mergers coming ahead.

A proper application of Competition Law in the digital economy requires a level playing field among the different types of transactions – monetary and non-monetary- as well as the diverse business models coexisting within the same markets. Microsoft/LinkedIn could be a good opportunity to see if Commission’s analysis is evolving in that sense.