Telefónica Public Policy & Telefónica España Regulatory teams

Telefónica Digital and Startup Genome have recently published a report with the most important startup ecosystems of the world.

Telefónica Digital and Startup Genome have recently published a report with the most important startup ecosystems of the world.

The main finding of The Startup Ecosystem Report 2012 is that Silicon Valley is not the only important startup ecosystem in the world anymore. Although Silicon Valley remains as the world’s largest and most-influential start-up ecosystem, it no longer wields the power and influence it once did.

The reason is that other startups have flourished in the USA and other parts of the world (e.g. Latin America, Europe, the Middle East and Asia) over recent years and are now beginning to challenge Silicon Valley’s domination in technology innovation.

What does this change mean?

For the authors of the report this trend suggests that countries are shifting from service-based economies to become increasingly driven by a new generation of fast-moving software and technology organizations.

The report finds that the main alternative startup ecosystems to Silicon Valley are the following:

1) Tel Aviv,

2) Los Angeles,

3) Seattle,

4) New York City and

5) Boston.

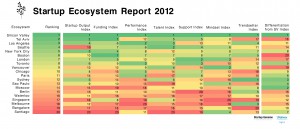

You can also see below the global rankings table:

The first column in the index is the overall ranking, followed by 8 weighted component indexes that are the inputs to the overall ranking. The authors of the report define the eight weighted component indexes as follows:

- Startup Output Index: it represents the total activity of entrepreneurship in the region, controlling for population size and the maturity of startups in the region.

- Funding Index: it measures how active and how comprehensive the risk capital is in a startup ecosystem.

- Company Performance Index: it measures the total performance and performance potential of startups in a given startup ecosystem, taking into account variables such as revenue, job growth, and potential growth of companies in the startup ecosystem.

- Talent Index: it basically measures how talented the founders in a given startup ecosystem are, taking into account age, education, startup experience, industry domain expertise, ability to mitigate risk and previous startup success rate.

- Support Index: it measures the quality of the startup ecosystem’s support network, including the prevalence of mentorship, service providers and types of funding sources.

- Mindset Index: it measures how well the population of founders in a given ecosystem think like a great entrepreneur, where a great entrepreneur is visionary, resilient, has a high appetite for risk, a strong work ethic and an ability to overcome the typical challenges startups face.

- Trendsetter Index: it measures how quickly a startup ecosystem adopts new technologies, management processes, and business models. Where startup ecosystems that stay on the cutting edge are expected to perform better over time.

- Differentiation Index: it measures how different a startup ecosystem is to Silicon Valley, taking into account the demographics and what types of companies are started there.

Although Tel Aviv is the main alternative to Silicon Valley, five of the six largest world ecosystems are located in the USA.

In Europe, London is by far the largest startup ecosystem although its output is still just a third of that of Silicon Valley.

Outside of the more traditional markets, the startup ecosystem in Sao Paulo is growing rapidly and creates more jobs for the local community than Silicon Valley does for its own.

The report also finds the ‘next 20’ startup ecosystems and present them in alphabetical order by cities. The authors note that this list does not show a ranking because there are less data available for identifying robust trends. However, the authors have presented the findings discovered thus far, and collated input from ecosystem stakeholders in each of these cities.

Madrid and Barcelona are in the ‘next 20’ list. Both cities are still far away from Silicon Valley but they have the necessary talent to become a serious alternative to London or Paris (the two European cities best ranked) in the future. The two Spanish cities would just need to reduce the gap with London and Paris in terms of support and financing. Researchers have also found the following outcomes

- Entrepreneurs of Madrid and Barcelona are the best trained in Europe only surpassed by the entrepreneurs of Paris.

- 91% of the entrepreneurs of Barcelona and 89% of the entrepreneurs of Madrid own a doctorate or a master degree on top of an 86% of the entrepreneurs of Berlin and a 75% of the entrepreneurs of London.

- However, the percentage of entrepreneur women in Madrid and Barcelona (3% and 5% respectively) is one of the lowest in Europe. These percentages are far from those of London (9%), Paris (7%) or Silicon Valley (10%).

You can download the full report here and contact the authors of the report via Twitter through the hashtag #startupecosystem and citing @tefdigital and @startupcompass.