Key Highlights

- 50-50 joint venture brings together Virgin Media, the U.K.’s fastest broadband network, and O2, the country’s largest mobile platform

- Combination creates a stronger fixed and mobile competitor in the U.K. market, supporting the expansion of Virgin Media’s giga-ready network and O2’s 5G mobile deployment for the benefit of consumers, businesses and the public sector

- Fully converged platform will put customers first and have the scale to innovate in the changing digital landscape, investing £10 billion in the U.K. over the next five years

- Joint venture expected to deliver substantial synergies valued at £6.2 billion on a net present value basis after integration costs, and equivalent to cost, capex and revenue benefits of £540 million1 on an annual basis by the fifth full year post-closing

- Attractive valuation for both businesses, with O2 valued at £12.7 billion and Virgin Media valued at £18.7billion, both on a total enterprise value basis. O2 to be transferred into the joint venture on a debt-free basis, while Virgin Media to be contributed with £11.3 billion of net debt and debt-like items 2

- Both parties expect to receive net cash proceeds at closing following a series of recapitalizations that will generate £5.7 billion in proceeds for Telefonica and £1.4 billion for Liberty Global (after an equalization payment to Telefonica of £2.5 billon 3)

- Joint venture will target ongoing net leverage of 4.0-5.0x, with proceeds from any future free cash flow generation and financing to be distributed equally between Telefonica and Liberty Global

- The transaction is expected to close around the middle of 2021 and is subject to regulatory approvals, consummation of the recapitalizations, and other customary closing conditions

Denver, Colorado and Madrid, Spain– May 7, 2020: Telefonica Chief Executive Officer, Jose Maria Alvarez-Pallete, said, “Combining O2’s number one mobile business with Virgin Media’s superfast broadband network and entertainment services will be a game-changer in the U.K., at a time when demand for connectivity has never been greater or more critical. We are creating a strong competitor with significant scale and financial strength to invest in UK digital infrastructure and give millions of consumer, business and public sector customers more choice and value. This is a proud and exciting moment for our organisations, as we create a leading integrated communications provider in the U.K.”

Mike Fries, Chief Executive Officer of Liberty Global, said, “We couldn’t be more excited about this combination. Virgin Media has redefined broadband and entertainment in the U.K. with lightning fast speeds and the most innovative video platform. And O2 is widely recognized as the most reliable and admired mobile operator in the U.K., always putting the customer first. With Virgin Media and O2 together, the future of convergence is here today. We’ve seen the benefit of FMC first-hand in Belgium and the Netherlands. When the power of 5G meets 1 gig broadband, U.K. consumers and businesses will never look back. We’re committed to this market and are right behind the Government’s digital and connectivity goals.”

Strategic Combination

Liberty Global plc (NASDAQ: LBTYA, LBTYB and LBTYK) and Telefonica SA (Madrid stock exchange: TEF) today announced an agreement to merge their operating businesses in the U.K. to form a 50:50 joint venture (the “JV”). The combination of Virgin Media and O2 will create a nationwide integrated communications provider with over 46 million video, broadband and mobile subscribers and £11 billion of revenue. 4

By combining Virgin Media’s market-leading v6 video service and giga-ready broadband network, together with O2’s best-in-class, 5G ready mobile propositions, U.K. consumers will enjoy the highest-quality customer experience possible, with superior connectivity and entertainment both inside and outside the home. As a fully converged provider, the JV will provide more competition in the marketplace and choice for consumers.

In addition, the JV will become a leading challenger in the B2B space as the combination will accelerate the adoption of converged fixed-mobile services to Virgin Media’s and O2’s existing business customers and offer new services using both companies’ digital skills, networks and product portfolios, such as cloud, big data, Internet of Things and cybersecurity services. This will ensure sustainable competition in the small, medium and large business segments across the U.K., which will benefit the overall British economy.

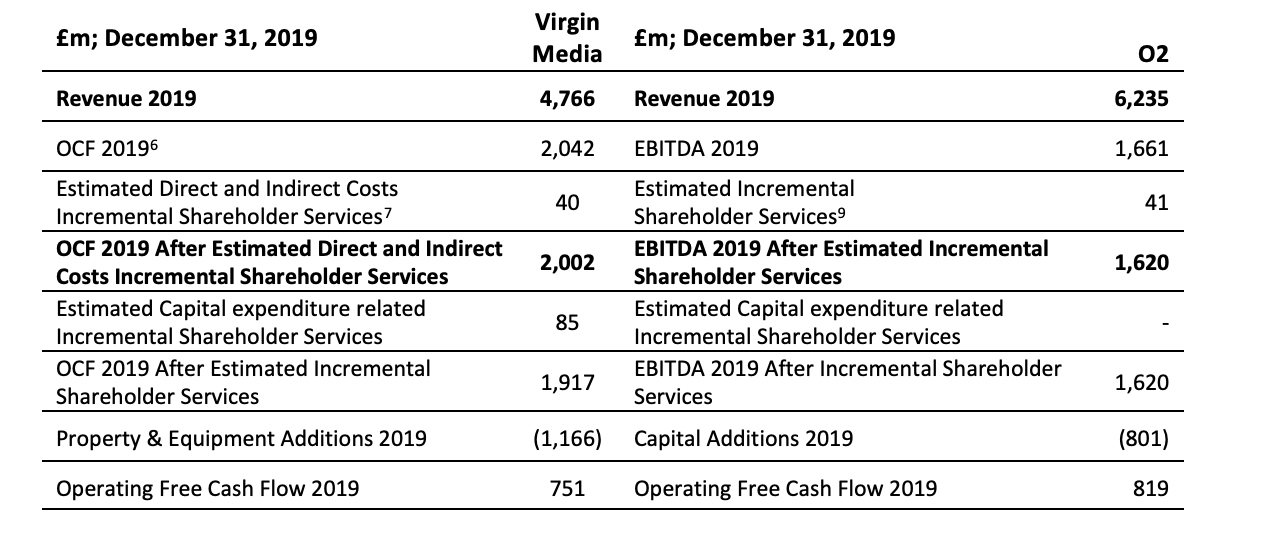

Financial Profile of the Joint Venture5

Telefonica and Liberty Global will ensure that the JV will benefit from the scale and complementary expertise of each partner. To accomplish that objective, the parties have agreed to provide a suite of services to the JV after closing. These services will principally consist of IT and technology-related services, procurement, brand management and other support services. The annual charges to the JV will ultimately depend on the actual level of services required by the JV.

Separate financial information for Virgin Media and O2 is presented below for the 12 months ended December 31, 2019.

The JV intends to distribute available cash to the shareholders periodically and is expected to undertake periodic further recapitalizations, subject to market and operating conditions, to maintain its 4.0x-5.0x target net leverage ratio8. Between signing and closing, each party will retain the free cash flow of their respective operations. Liberty Global will transfer effectively all of its UK tax capital allowances and tax loss carry-forwards, which primarily resulted from prior infrastructure investments, at closing to be utilized by the JV. Each party will fund the deficit in their respective defined benefit pension schemes, arising from the next triennial actuarial valuation.

Neither Telefonica nor Liberty Global will consolidate the JV after the closing.

Transaction Details

The transaction will include a series of recapitalization financings prior to closing to reach its target closing net leverage ratio for the JV of 5.0x, or approximately £18 billion of long-term debt. Net new proceeds from the recapitalizations are targeted to be approximately £6 billion. After taking into account the recapitalizations, Telefonica is expected to receive £5.7 billion in total proceeds from the transaction. Liberty Global is expected to receive £1.4 billion in total, including approximately £800 million from the recapitalization of its retained and 100% owned Virgin Media Ireland business. The transaction will not trigger a change of control under Virgin Media’s existing third-party debt that will be contributed in full to the joint venture. As part of the transaction, a syndicate of banks has underwritten a £4 billion standalone undrawn financing on the O2 business.

These transaction proceeds will be determined based upon (i) equalization payments to take into account the relative valuation of the two businesses and (ii) the proceeds generated from the recapitalization transactions. With respect to the equalization payments, based upon the enterprise value of each business, and after deducting debt and debt-like items, Liberty Global will make a cash payment to Telefonica of £2.5 billion. However, this payment by Liberty Global will be offset by receipt of proceeds from the recapitalizations described above such that at closing Liberty Global receives cash proceeds from the transaction.

Synergy Opportunity

The JV is expected to generate significant operating benefits, with estimated run-rate cost, capex and revenue synergies of £540 million1 on an annual basis by the fifth full year post closing, equivalent to a net present value of approximately £6.2 billion post tax and net of integration costs, as well as significant synergies from the accelerated usage of existing tax assets.

The vast majority of the benefits relate to demonstrable cost and capex synergies, with an annual run-rate of approximately £430 million out of which approximately 80% are expected to be achieved by the third full year after the closing. The key expected sources of cost and capex synergies include:

- Use of existing infrastructure to provide services for each entity’s customers at lower cost compared to standalone / wholesale capabilities;

- Migration of Virgin Media mobile traffic to Telefonica UK’s network;

- Combination of regional and national network infrastructures and IT systems;

- Reduction in combined marketing expenditures;

- Potential to reduce general and administration costs; and

- Site rationalization

In addition, the JV is expected to realize significant growth through cross-selling opportunities and scale, resulting in revenue synergies with an estimated annual run-rate of approximately £110 million on an annual basis.

To achieve these synergies, the JV expects to incur approximately £700 million of integration costs, most of which should be incurred in the first four years after the closing.

With extensive track records of delivering value creation, Liberty Global and Telefonica bring significant experience in the integration and execution of identified synergies in the context of in-country consolidations and convergence transactions across Europe and worldwide.

Management, Governance and Liquidity Provisions

Executive leadership of the JV will be agreed prior to the closing. The board will consist of eight members, four from each of Liberty Global and Telefonica. Mr. Fries, CEO of Liberty Global, and Mr. Alvarez-Pallette, CEO of Telefonica, will sit on the board. The post of Chairman will be held for alternating two-year periods by Liberty Global or Telefonica with Liberty Global holding the position first.

Each shareholder has the right to initiate an initial public offering of the JV after the third anniversary of the closing. The parties have agreed to restrictions on other transfers of interests of their shares in the JV until the fifth anniversary of closing. After the fifth anniversary, each shareholder will be able to initiate a sale of the entire JV to a third party, subject to a right of first offer in favor of the other shareholder.

Closing Conditions and Indicative Timetable

Liberty Global and Telefonica anticipate that closing of the transaction is expected to take place around the middle of 2021.

The transaction is subject to regulatory approval. Liberty Global and Telefonica have already undertaken preparatory work on the required competition filing and will formally request approval from the appropriate authority in due course. The transaction is also subject to a condition that the recapitalizations have occurred and other closing conditions customary for transactions of this type.

With respect to the upcoming U.K. spectrum auction, each party will operate as standalone entities and make independent decisions regarding strategy and participation. As such, each party will bear its own individual costs for the auction.

The transaction is not subject to Telefonica or Liberty Global shareholder approvals. Liberty Global’s Irish operations are not part of the transaction.

Investor and Analyst Calls

Telefonica is hosting a conference call on Thursday, May 7, 2020 for analysts and investors, which will start promptly at 10.00 a.m. (London time). Please dial into this conference call using the following numbers:

UK Participant dial in Toll: +44 (0)330 336 9401

UK Participant dial in Toll-Free: 0800 279 4827

US Participant dial in Toll: +1 929-477-0338

US Participant dial in Toll-Free: 800-289-0459

Participant Passcode: 196368

Liberty Global is hosting a conference call on Thursday, May 7, 2020 for analysts and investors. The call will start promptly at 09.00 a.m. (New York Time). During the call Liberty Global will discuss its Q1 2020 results and business, and expects to address the joint venture, comment on the company’s outlook and provide other forward-looking information.

Please dial into this conference call using the following numbers:

United States

+1 720 543 0210

International +1 888 378 4398

The conference passcode is 852843. The conference call will also be webcast live from www.libertyglobal.com

Transaction Advisers

In connection with the transaction, J.P. Morgan and LionTree Advisors are acting as financial advisers to Liberty Global, and Allen & Overy is acting as legal adviser to Liberty Global, with Shearman & Sterling providing U.S. legal advice. Citigroup is acting as financial adviser to Telefonica and Clifford Chance and Herbert Smith are acting as legal adviser to Telefonica.

Deal Website

To find out more and to follow our progress, visit www.nationalconnectivitychampion.co.uk

About Telefonica

Telefónica is one the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 344 million customers, Telefónica operates in Europe and Latin America.

Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

About Liberty Global

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is one of the world’s leading converged video, broadband and communications companies, with operations in six European countries under the consumer brands Virgin Media, Telenet and UPC. We invest in the infrastructure and digital platforms that empower our customers to make the most of the digital revolution. Our substantial scale and commitment to innovation enable us to develop market-leading products delivered through next-generation networks that connect 11 million customers subscribing to 25 million TV, broadband internet and telephony services. We also serve 6 million mobile subscribers and offer WiFi service through millions of access points across our footprint.

In addition, Liberty Global owns 50% of VodafoneZiggo, a joint venture in the Netherlands with 4 million customers subscribing to 10 million fixed-line and 5 million mobile services, as well as significant investments in ITV, All3Media, ITI Neovision, Lionsgate, the Formula E racing series and several regional sports networks. For more information, please visit www.libertyglobal.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “may,” “target,” and similar expressions and variations or negatives of these words. These forward-looking statements may include, among other things, statements relating to the outlook in the U.K. of Telefónica, S.A. (“Telefónica”) and Liberty Global plc (“Liberty Global”) and their respective operating companies O2 UK and Virgin Media; operational expectations, including with respect to the development, launch and benefits of innovative and advanced products and services, including gigabit speeds, new technology and next generation platform rollouts or launches; future growth prospects and opportunities, results of operations, uses of cash, share repurchases, tax rates, and other measures that may impact the financial performance of the companies; anticipated benefits and synergies and estimated costs of the proposed transaction; the expected timing of completion of the proposed transaction; and other information and statements that are not historical facts. These forward-looking statements involve certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties include events that are outside of the control of the parties, such as: (i) Telefónica, Liberty Global, and our respective operating companies’ ability to meet challenges from competition and to achieve forecasted financial and operating targets; (ii) the effects of changes in laws or regulations; (iii) the effects of the U.K.’s exit from the E.U.; (iv) general economic, legislative, political and regulatory factors, and the impact of weather conditions, natural disasters, or any epidemic, pandemic or disease outbreak (including COVID-19); (v) Telefónica, Liberty Global, and our respective affiliates’ ability to obtain regulatory approvals and satisfy other conditions to the consummation of the proposed transaction; (vi) the proposed transaction may not be completed on anticipated terms and timing or completed at all; (vii) Telefónica, Liberty Global, and our respective affiliates’ ability to successfully integrate the combined businesses and realize anticipated efficiencies and synergies from the proposed transaction; (viii) the outcome of any potential litigation that may be instituted with respect to the proposed transaction; (ix) the potential impact of unforeseen liabilities, future capital expenditures, revenues, expenses, economic performance, indebtedness, financial condition on the future prospects and business of the combined business after the consummation of the proposed transaction; (x) successful closing of expected financing and recapitalization transactions undertaken in connection with the proposed transaction and risks associated such transactions; (xi) any negative effects of the announcement, pendency or consummation of the proposed transaction; and (xii) management’s response to any of the aforementioned factors. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, please see Telefónica’s and Liberty Global’s respective filings with the U.S. Securities and Exchange Commission, including Liberty Global’s most recently filed Form 10-Q and Telefónica’s most recently filed Form 20-F, as well as the documents filed by Telefónica before the different supervisory authorities of the securities markets in which its shares are listed and, in particular, the Spanish National Securities Market Commission. These forward-looking statements speak only as of the date of this release. Telefónica and Liberty Global expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Enquiries:

Telefonica

Investor Relations

Telephone +34 91 482 87 00

Pablo Eguirón ([email protected])

Isabel Beltrán ([email protected])

AdriánZunzunegui ([email protected])

Media Relations

Telephone +34 91 482 3628

Fiona Maharg ([email protected])

Liberty Global

Investor Relations

Matt Coates +44 20 8483 6333

John Rea +1 303 220 4238

Stefan Halters +44 20 8483 6211

Corporate Communications

Molly Bruce +1 303 220 4202

Matt Beake +44 20 8483 6428

1 – The £540 million synergies estimate is comprised of £350 million of cost savings, approximately £80 million of capex and £110 million of revenue synergies. Additional tax synergies may be realized.

2 – Virgin Media’s £11.3 billion of net debt is based upon third-party net debt and transaction related debt-like adjustments as of December 31, 2019 and is subject to customary closing adjustments. O2 is subject to £0.3 billion of transaction related debt-like and working capital adjustments as of December 31, 2019 and is subject to customary closing adjustments.

3 – Equalisation payment after taking into account debt and debt-like items and customary normalised working capital adjustment as if completion occurred on the 31st of December 2019.

4 – Represents combined revenue generating units of Liberty Global and Telefonica (as defined by each) as at December 31, 2019.

5 – Virgin Media amounts are prepared under United States Generally Accepted Accounting Principles and Telefonica O2 amounts are prepared under International Financial Reporting Standards used in the European Union. Therefore amounts shown have been calculated under different standards.

6 – For Virgin Media, OCF represents operating income before share-based compensation, related-party fees and allocations, depreciation and amortization, impairment, restructuring and other operating items. Includes £37 million in charges from Liberty Global in 2019. These services are expected to continue post transaction.

7 – Represents estimated additional charges that we expect will be reported in OCF post transaction for services provided, and for use of assets retained, by Liberty Global.

8 – Including charges in connection with all Incremental Shareholder Services and liabilities associated with operating leases.