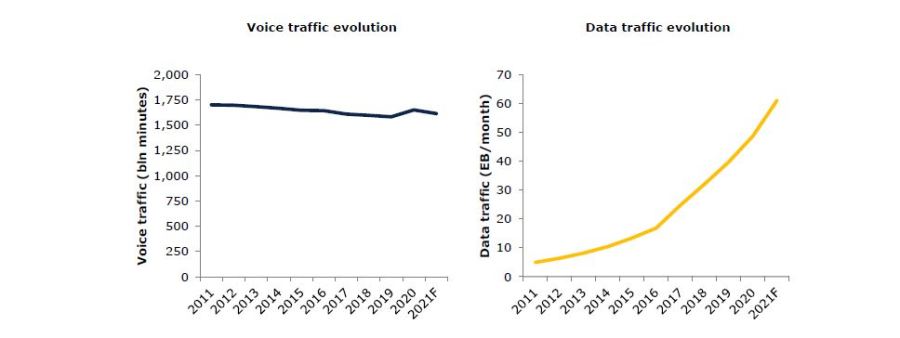

The exponential Internet data traffic growth poses a challenge to the sustainability of investment in European networks, while resulting in additional negative externalities in terms of energy consumption and carbon emissions.

Telecom companies are shouldering alone the needed investment to address this increasing traffic demand, financing expansion of network capacity and coverage exclusively from revenues coming from broadband connectivity and other services provided to end-customers. OTTs (Over-The-Top) platforms, who do not compensate network operators for the cost of delivering the traffic to end customers through the operators’ networks, have a business model where profits increase by delivering more traffic, thus further reinforcing Internet traffic growth pattern and mounting pressure on network investments.

Shouldn’t largest traffic generators fairly contribute to the cost of delivering their traffic to end customers? What is actually the cost of delivering the traffic? And what would be impact of this approach and how could it be implemented?

Reports from Frontier Economics and Axon shed light on these pressing issues, with the first calculating the economic cost of delivering OTTs traffic over European telecom networks, and the latter analysing the socioeconomic impact of OTTs assuming a share of such costs, and how this could be implemented.

Exponential growth of data traffic carried by telecom networks

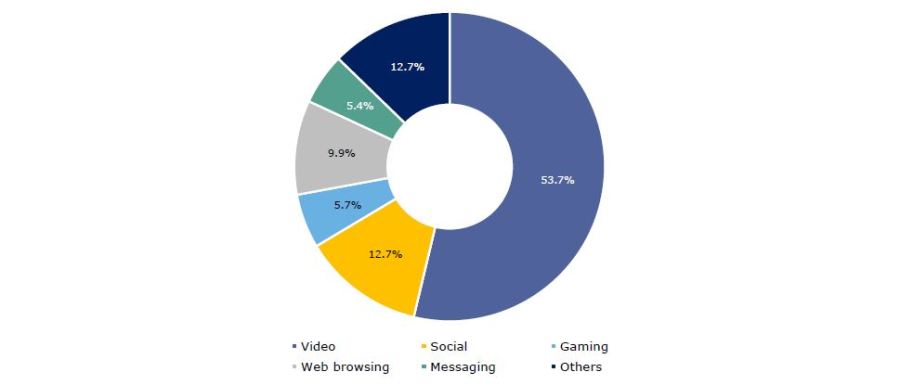

Internet bandwidth spiked 30% annually in 2020 and 2021, and this trend is due to continue in the years to come. Video streaming, social media and gaming account for over 70% of Internet traffic, with just 6 companies accounting for over 56% of total Internet traffic.

European telecom operators have invested €500 billion in the last 10 years to ensure networks can handle this traffic growth. But continued investment is needed to ensure EU citizens can participate in our digital society without restrictions. José María Álvarez-Pallete, CEO and Chairman of Telefónica, together with his counterparts from Deutsche Telekom, Orange and Vodafone are calling for OTTs digital platforms to share the burden in a fair and proportionate way to their use of telecom networks.

The costs of traffic and socio-economic impact of a fairer contribution

The new study from Frontier has calculated the cost of delivering OTTs traffic in European networks. Frontier’s analysis —based on cost, traffic and network data provided to the consultancy by Deutsche Telekom, Orange, Telefónica and Vodafone— has determined an annual cost ranging from €36 bn. to €40 bn. for European networks following a full allocation cost model, and from €15 bn. to €28 bn. following an incremental cost allocation model.

Axon’s report starts analysing the relationship framework between the European telecom operators and the largest OTTs. Given the asymmetric bargaining power and unbalanced regulatory framework, network operators are unable to negotiate with OTTs receiving a fair payment for conveying OTTs traffic to end customers.

According to Axon’s diagnosis, the exploding data traffic together with massive investment requirements to expand capacity and coverage of 5G and fibre networks, in a context of falling telecommunications revenues and a lack of payments from OTTs to cover their traffic costs, results in massive disadvantage for the European sector.

As a result, EU telecom sector is left at a financially weaker position impairing their investment capacity on 5G and fibre networks and, thus, challenging the expected expansion frameworks of 5G and FTTH. Additionally, absent any direct traffic cost on telecom networks, there is no price incentive for OTTs to generate traffic more efficiently and thus insufficient motivations to control and reduce traffic related energy consumption and CO₂ emissions to limit the carbon footprint —climate protection loses out—.

“Delivering OTT traffic over European telecom networks results in a €36 bn to €40 bn annual cost to telecom providers. OTTs contributing to cover this cost would not only assure networks capability to cope with the increasing demand but also would have a positive socio-economic impact by strengthening EU GDP growth and job creation and advance in the achievement of EU green deal targets.”

Acknowledging Frontier’s report results on the cost of traffic induced by OTTs, Axon analyses the socioeconomic impact of OTTs paying European network operators for delivering their traffic to end customers in three alternative scenarios: annual payments of €10 bn., €20 bn. and €30 bn. The impact of accelerated network expansion on the back of OTTs payments in the amount of €20 bn would have a multiplier effect on the European economy, boosting economic output -GDP- in just four years’ time by up to €72 bn. and creating 840,000 new jobs. This faster deployment of networks will also speed up traffic migration to more energy efficient 5G and fibre networks, enabling a reduction of 28% of energy consumption and of 94% of the carbon footprint for the sector in 2025.

Finding a solution: an obligation to negotiate an agreement

But the relevant question remains how ensure a framework where European telecom operators receive from large OTTs a fair payment for the usage of their networks to deliver the traffic to end customers, in line with the European Commission call for all market players to make a “fair and proportionate contribution” to the cost of infrastructure.

Axon considers different regulatory options, including an indirect compensation mechanism through a special fund or a form of digital taxation. Nevertheless, the consulting firm finds the most fit for purpose solution the imposition of clear obligation for largest OTTs to negotiate the conclusion of a direct agreement with telcos upon request, and to accept to pay a fair and proportionate contribution to network usage costs. Axon also elaborates on the relevant establishment of arbitration mechanisms in case no agreement is reached in negotiations.

It is now time for Europe —the EU Commission, the Parliament and Member States— to start working on the definition and implementation of an European solution, not only ensuring the long-term sustainability and quality of European networks, but also boosting digital economy by fostering the achievement of the twin digital and green transition.

This would be the most serious step to truly make possible the objectives set by the EC itself (Digital Compass 2030) for the digital society that all European citizens and companies need before the end of this decade.

- Fairer balance between tech giants and telecom operatorsAxon report on Europe’s internet ecosystem: socio-economic benefits of a fairer balance between tech giants and telecom operatorsPDF | 1 MB

- Frontier Economics report on OTT traffic-related costs on EU telecom networkdPDF | 636 KB