Madrid, 21st February 2019

Telefónica’s net profit increased 6.4% in 2018 to €3,331M:

- Leader in fiber, both in Europe and Latin America: more broadband customers in fiber/cable (61%) than copper

- Growing organically in annual revenues for the first time in 10 years in Spain and record profitability in Brazil

- Largest free cash generation in 4 years (ex spectrum)

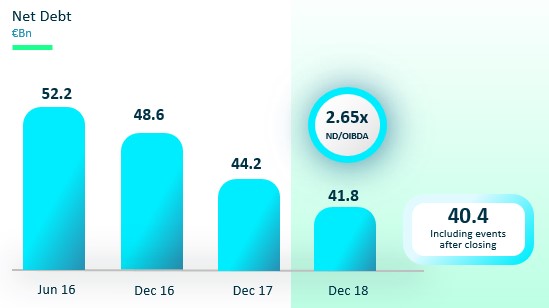

- Reduced debt by around €12bn since June 2016

- Proactive portfolio management and optimisation of return on capital employed

Highlights:

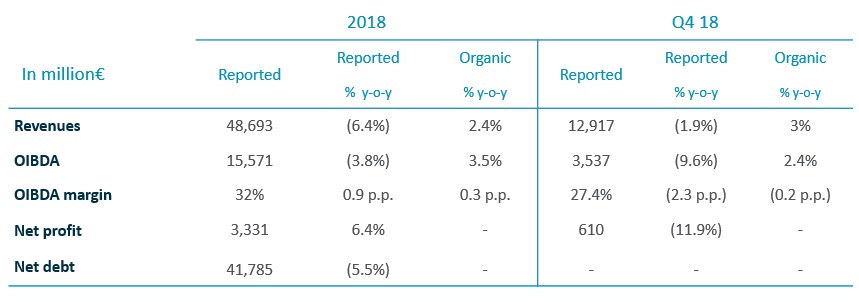

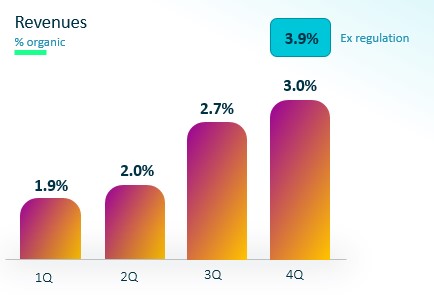

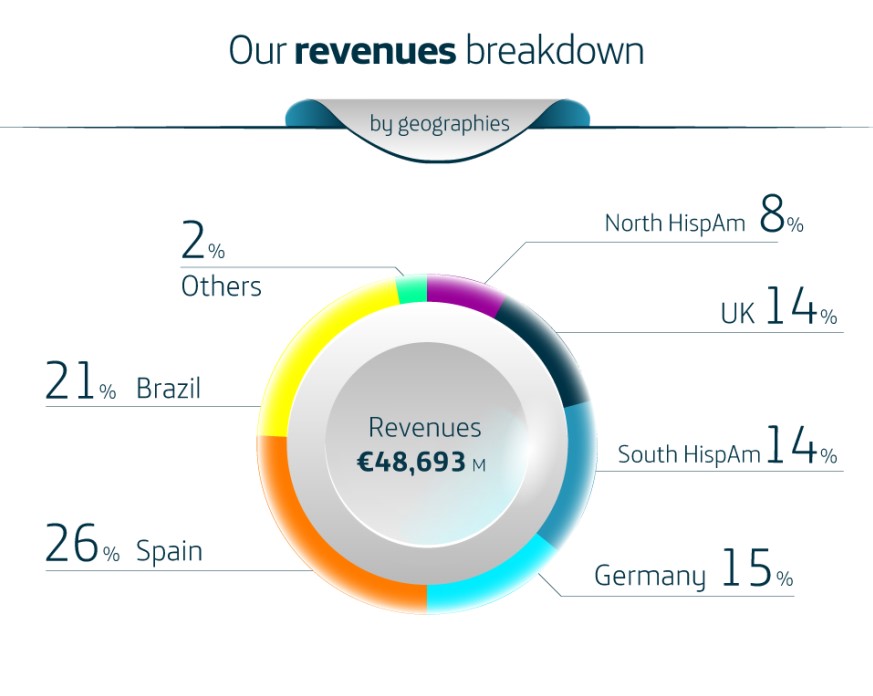

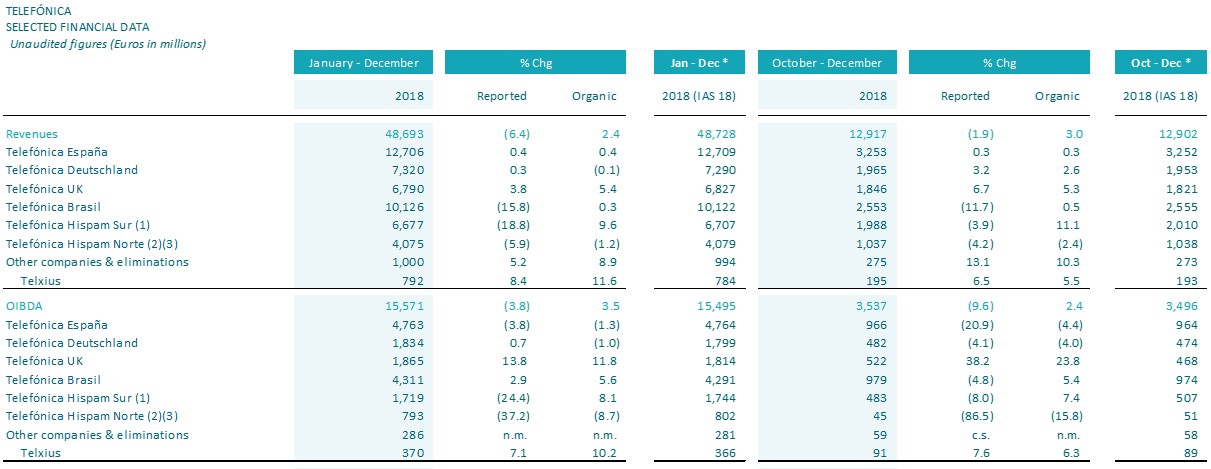

- Revenues increased 2.4% y-o-y organic (-6.4% reported) in 2018 to €48,693m. In the quarter, revenues accelerated growth up to 3% y-o-y (-1.9% reported), to €12,917m.

- OIBDA reached €15,571m in 2018 and grew +3.5% y-o-y organic (-3.8% reported). In the fourth quarter grew 2.4% (-9.6% reported).

- Net debt fell for the 7th consecutive quarter and stood at €41,785m as of December 2018 (5.5% y-o-y reduction). Free cash flow excluding spectrum (€5,578m in January-December) rose 5.3% y-o-y.

- Telefónica met 2018 objectives and announces today a new guidance for 2019 (organic):

- Revenues: growing around 2%

- OIBDA: growing around 2%

- CapEx/Sales excluding spectrum: around 15%

- The Company confirms shareholder remuneration for 2018 (second tranche of €0,20 per share to be paid in June 2019); and proposes a remuneration policy for 2019, a dividend of €0.40 per share in cash, to be paid in December 2019 (€0.20 per share) and in June 2020 (€0.20 per share).

José María Álvarez-Pallete, Executive Chairman:

“If I had to define this year 2018, I would define it as the year that passed the halfway mark in the transformation of Telefónica. Today I can assure you that Telefónica is closer to the company we want to be than to the company we were.

Our solid set of fourth-quarter results reflected the improvement in business’ sustainability. Value customers and their average lifetime continued increasing, while both revenue and operating cash flow growth accelerated.

In 2018, we regained customer relevance, resulting in the best-ever figure of customer satisfaction. We continued increasing the weight of high-growing revenues (broadband connectivity and services beyond connectivity) and investing in state-of-the-art technology networks. At the same time, we continued improving the Company’s financial flexibility with a solid free cash flow, growing ex-spectrum, which enabled us to reduce net debt for the third consecutive year. And all this, notwithstanding the negative impact from regulation.

This performance, together with the remarkable operating momentum in the initial months of 2019, allow us to announce with confidence our 2019 targets of continue growing in revenues and OIBDA, as we keep the CapEx/Sales ratio stable. In addition, we announce a stable, sustainable and attractive dividend in 2019 of 0.40 euros per share in cash, on the back of a solid and consistent cash flow generation”.

Financial Results January-December 2018:

Telefónica presented today its financial results for the year 2018, which highlights its profitable and sustainable growth, the efficient use of resources, the radical transformation of networks and improved customer quality and experience. Also noteworthy is the strong net debt reduction of €2,445m in the year. Including post-closing events in the first two months of 2019 (divestments of Telefónica Centroamérica and Antares) debt would be further reduced by €1.4bn.

Growing in value

Telefónica closed 2018 with 356.2m accesses, with a high value costumer base which accelerated average revenue per access growth to +3.8% y-o-y in organic terms in the quarter (+3.2% in January-December), while churn remained stable. Also during the fourth quarter, the strong commercial momentum of high value customers continued, with growth of LTE customers (117.4m, +20% y-o-y); mobile contract accesses (+7% y-o-y up to 123.8m) and smartphones (+6% y-o-y, up to 167.7m). FTTx/cable accesses reached 13,2m (+21% y-o-y) and represent already 61% of total fixed broadband accesses, while pay TV accesses stood at 8.9m (+5% y-o-y).

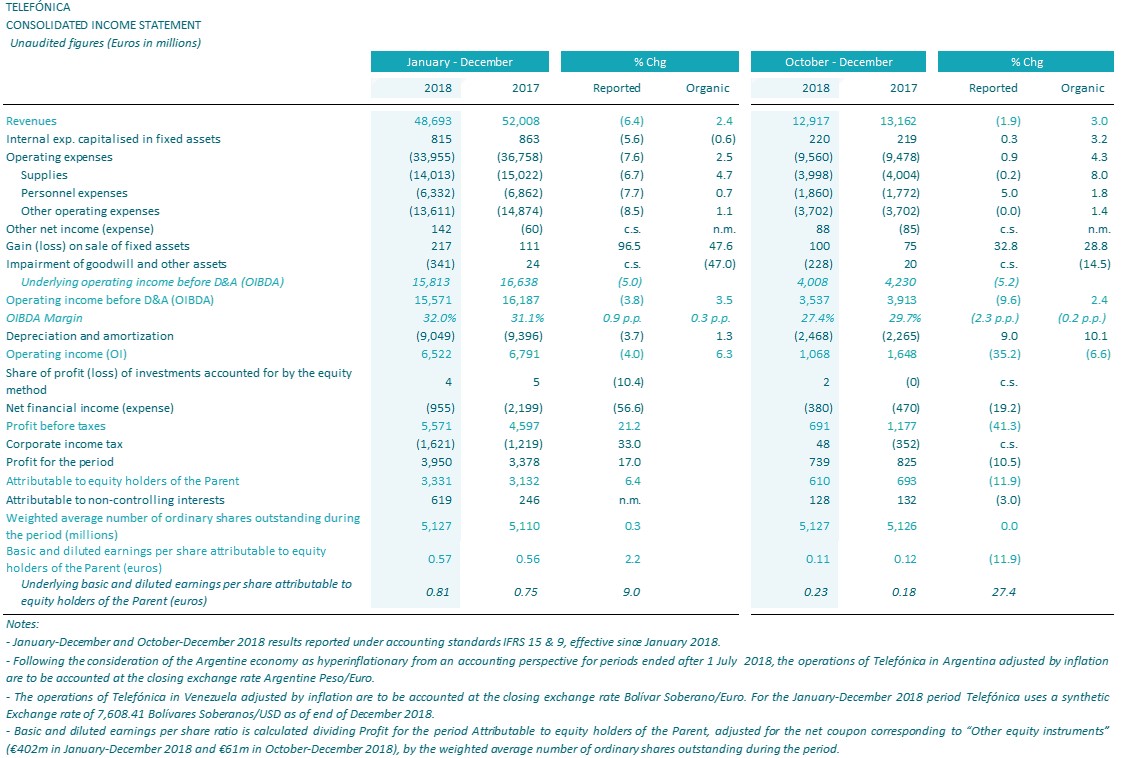

Revenues in 2018 stood at €48,693m and grew 2.4% y-o-y in organic terms (-6.4% reported). In the quarter revenues reached €12,917m and the growth trend continued to accelerate to 3% in organic terms (-1.9% y-o-y reported), on the back of the improvement in service revenues (+1.3% in October-December; +1% in 2018) and the strong progress in handset sales (+18.5% in the fourth quarter; +18.8% in 2018).

Operating expenses (€9,560m in October-December; €33,955m in January-December) increased in the quarter by 0.9% y-o-y (-7.6% in January-December), while in organic terms, operating expenses increased by 4.3% y-o-y in October-December (+2.5% in 2018).

Operating income before depreciation and amortisation (OIBDA) stood at €15,571m in January-December (-3.8% y-o-y) and reached €3,537m in October-December (-9.6% y-o-y) affected by restructuring charges and goodwill impairments, as well as exchange rate effect.

In organic terms, OIBDA increased by 3.5% in 2018 (2.4% y-o-y in the quarter), despite higher operating expenses, reflecting the positive revenue growth, savings from digitalization and simplification, among other cost containment efforts. Excluding the impact from regulation (-0.9 p.p. in the fourth quarter and -1.7 p.p. in January-December), OIBDA would have risen by 3.3% y-o-y in organic terms in October-December and by 5.1% in 2018.

Fourth quarter was affected by a hyperinflation adjustment in Argentina (+€80m) and other net effects amounting to -€552m, including restructuring costs (-€363m), a goodwill write-off in Mexico (-€242m), the adoption of IFRS 15 (+€40m) and tower sales (+€19m).

OIBDA margin stood at 32% in the year (+0.9 p.p. y-o-y) and 32.3% in organic terms (+0.3 p.p. y-o-y). In the quarter reached 27.4% (-2.3 p.p. y-o-y) and 32.0% in organic terms (-0.2 p.p. y-o-y).

Net profit in 2018 stood at €3,331m and grew 6.4% vs 2017. In the fourth quarter it reached €610m, down 11.9% y-o-y. Basic earnings per share reached €0.57 in 2018 and grew 2.2%. In the quarter it totalled €0.11, down 11.9% y-o-y.

Free cash flow reached €4,904m in January-December 2018 (-0.9% y-o-y), +5.3% excluding spectrum payments (€5,578m). Operating cash flow (OIBDA-CapEx) reached €7,453m in January-December 2018 and fell by 0.5% y-o-y. In organic terms, it grew by 8.0% in 2018 (+31.1% y-o-y in the fourth quarter), reflecting the improved business performance and lower capital intensity.

Also, the depreciation against the euro of foreign currencies which Telefónica is exposed to, in particular the Brazilian real and the Argentine peso, had a negative impact on the Company’s reported results. In the fourth quarter, the exchange rate evolution (excluding the hyperinflation adjustment) reduced y-o-y growth of revenues by -8.2 p.p. and -9.3 p.p. respectively in January-December. However, the negative impact of the depreciation of currencies seen at the OIBDA level (-€1,511m in 2018) was significantly reduced in terms of cash flow generation (-€508m), since the depreciation also lowered payments of CapEx, taxes, and dividends to minority shareholders. The evolution of exchange rates also allowed the Company to reduce net financial debt by €213m over the last 12 months.

Organic growth: Assumes average constant foreign exchange rates of 2017, except for Venezuela (2017 and 2018 results converted at the closing synthetic exchange rate for each period) and excludes in 2018 the hyperinflation adjustment in Argentina. Considers a constant perimeter of consolidation. Excludes the effects of the accounting change to IFRS 15 in 2018, write-downs, capital gains/losses from the sale of companies, tower sales, restructuring costs and material non-recurring impacts. CapEx excludes spectrum investments.

Meeting guidance and shareholder remuneration

Telefónica meets guidance for 2018 and announces its guidance for 2019 (organic)[1]:

- Revenues: growing around 2%

- OIBDA: growing around 2%

- CapEx/Sales: around 15%

On the other hand, the Company confirms shareholder remuneration for 2018 and proposes the remuneration policy for 2019[2]:

- The second part of the 2018 dividend (€0.20 per share in cash) will be paid in June 2019.

- Dividend for 2019 of €0.40 per share in cash, to be paid in December 2019 (€0.20 per share) and in June 2019 (€0.20 per share).

Debt reduction for seven consecutive quarters

Net financial debt at December (€41,785m) decreased by €2,445m compared to December 2017 thanks to free cash flow generation (€4,904m), net financial divestments (€392m) and other factors for a net amount of €532m. On the other hand; i) shareholder remuneration (€2,608m, including coupon payments and the replacement of capital instruments) and ii) labour-related commitments (€775m), increased debt.

Including post-closing events (divestments of the operations in Telefonica Centroamérica and Antares), net financial debt would be further reduced by almost €1.4 bn. Debt fell by the seventh consecutive quarter and fell by €851m in the fourth quarter of the year.

In January-December 2018, the financing activity of Telefónica amounted to approximately €12,494m equivalent (without considering the refinancing of commercial paper and short-term bank loans) and focused on maintaining a solid liquidity position, and refinancing and extending debt maturities (in an environment of low interest rates). Therefore, as of the end of December, the Group has covered debt maturities for the next two years. The average debt life stood at 9.0 years (vs. 8.1 years in December 2017).

After the closing, in January Telefónica concluded its first green bond issuance, the first in the telco sector, through which it obtained an amount of €1,000 million maturing in February 2024 and with an annual coupon of 1.069%.

On the other hand, the estimated increase in the leverage ratio, as a result of the changes introduced by IFRS 16, in effect since January 1, 2019, is of approximately 0.2x.

Radical network transformation and efficient use of resources

CapEx for January-December (€8,119m; -6.6% reported; -1.3% organic) continued to focus on the radical transformation of networks and on improving quality and customer experience. The Group’s FTTx/cable coverage at the end of December reached 82.7m premises passed (50.5m of own network, +14% y-o-y); 21.3m FTTH in Spain, 9.4m FTTx/cable in Hispam (+37% y-o-y) and 19.8m in Brazil. Connected accesses increased by 21% y-o-y (13.2m) and more than 44% of our broadband customers enjoy connection speeds above 50 Mbps. LTE coverage reached 76% (+3.6 p.p. y-o-y; 94% in Europe and 70% in Latam) and LTE traffic already accounted for 65% of total traffic.

The End to End digitalization program, the deployment of technology and the continuous review of our processes, has allowed us to reach more than €300m savings in 2018.

The business revenues at a Group level increased by 3.4% y-o-y in 2018, up to €9,622m, and represents nearly 20% of Group’s revenues, mainly thanks to the growing contribution of digital services revenues.

Digital services revenues grew 24% in 2018 up to €6,790m (€1,889m in Q4; 20.7% y-o-y) and already account for 15% of revenues. If consider together with broadband revenues, represent 53% of Telefonica total revenues.

Results by geographies:

(y-o-y changes on organic terms)

Telefónica España: sustainable growth and leader in profitability. Telefónica España results in the fourth quarter of 2018 confirm the strength and the gradual improvement of its growth rate, posting an acceleration in service revenues growth (+0.6% y-o-y, +0.6 p.p. vs previous quarter), though still affected by regulation and the loss of the Yoigo/Pepephone wholesale contract (+2.0% y-o-y excluding these impacts).

As a result, in 2018 revenues grew +0.4% y-o-y, with a faster advance in the consumer segment and a return to growth in corporate revenues while organic OIBDA margin remained at 40%, despite the already expected increase in content costs. Operating cash flow generation also increased (+0.6% y-o-y) on the back of the positive revenue performance and the lower level of investments (-5.1% y-o-y) derived from the broad 4G and fibre coverage.

In 2018, total revenue (€12,706m) and service revenue (€12,320m) grew 0.4% and 0.3% y-o-y respectively. Service revenues have been posting annual growth for six quarters in a row. Revenues amounted to €3,253m (+0.3% y-o-y), improving from the previous quarter (+0.1 p.p.) thanks to the acceleration of service revenue growth (€3,144m; +2.0% y-o-y excluding the regulatory impact mentioned above and the loss of the MVNO contract, +0.6 p.p. q-o-q) and despite lower handset sales (-7.8% y-o-y; vs. +4.6% in July – September). In 2018, OIBDA reached €4,763m (-1.3% y-o-y; €966m in Q4, -4.4% y-o-y) and OIBDA margin was 37.5%, (-0.7% p.p. y-o-y) mainly affected by the restructuring provision.

CapEx in 2018 amounted to €1,719m, falling for the second year in a row (-5.1% y-o-y), due to the lower pace in deployment of the 4G network and the capture of efficiencies, leading to growth in operating cash flow to €3,044m (+0.6% y-o-y).

Telefónica Deutschland: best in class network for the largest mobile customer base. Telefónica Deutschland continued to show a positive operational momentum, in a dynamic yet rational market environment. Telefonica Deutschland remained focused on profitable growth by stimulating data usage and monetising data demand (O2 Free tariff portfolio with double-data “Boost” option and the unique “O2 Connect”). During the quarter the Company largely finalised its network integration, with significant quality improvements. In Connect magazine, O2 achieved the best rating across user profiles in the category “tariff” and in “service”. While all providers scored at an overall high level, O2‘s achievement delivers the first milestone of its “Mobile Customer and Digital Champion” strategy. On the 5th of February, the new “O2 my All in One XL” convergent tariff was launched in order to provide better service to convergence-oriented customers.

Revenues reached €7,320m (-0.1% y-o-y) in 2018 and €1,965m in Q4 (+2.6% y-o-y) mainly driven by the strong seasonal demand for handsets. OIBDA (€1,834m in 2018; 1% y-o-y) totalled €482 in the quarter (-4.0% y-o-y) mainly due to lower incremental synergies (~€10m vs ~€45m in Q4 17; ~€100m in 2018 vs ~€160m in 2017), regulatory impacts driven by usage elasticity effects from the RLAH-regulation and tougher comps due to the capital gains of assets (€29m) in Q4 17. Ex-regulation OIBDA grew +1.8% in 2018 and declined 2.8% y-o-y in Q4. As a result, OIBDA margin was 25.1% in 2018 (-0.2 p.p. y-o-y) and 24.5% in the quarter (-1.8 p.p. y-o-y).

CapEx of €966m in 2018, up +1.7% y-o-y, mostly driven by LTE rollout and the final stage of network integration, more than offsetting incremental CapEx synergies (~€15m in Q4, ~€50m in 2018). As such, 2018 operating cash flow (OIBDA-CapEx) reached €868m.

Telefónica UK: good results and commercial traction. Telefónica UK delivered another strong set of results and continued to grow key metrics. The initial take-up of O2’s “Custom Plans” which provide customers with better flexibility and control (launched at the end of August) has been one of the key drivers of the Company’s commercial traction. O2 continued leading sector customer loyalty, reporting the lowest postpay churn in the market at an unchanged 1.0%.

Revenues continued growing to €6,790m, up 5.4% y-o-y for the full year (€1.846m, 5.3% y-o-y). This revenue increase was mainly driven by higher value smartphone sales, increased customer spending as well as continuing growth in MVNO and Smart Metering Implementation Programme (SMIP) revenues. OIBDA totaled €1,865m in 2018 (+11,8%) and €522m in the quarter, up to +23.8% y-o-y, reflecting healthy top-line performance and strong margin expansion. Thus, OIBDA margin improved by 3.8 p.p. y-o-y to 28.3% in the quarter (27.5% up +1.5 p.p. for the full year).

CapEx in 2018 amounted to €1,464m, up 7.1% y-o-y organically, on the back of continuing investments in network capacity and customer experience; it is also worth mentioning the €588m investment in awarded spectrum in April 2018. Operating cash flow (OIBDA-CapEx) strongly improved in 2018 by 16.5% y-o-y.

Telefónica Brasil: record profitability and robust cash generation. In the fourth quarter, Telefónica Brasil returned to revenue growth (+0.5% y-o-y) thanks to the improvement seen in prepay and broadband. In addition, operating expenses decreased for the twelve consecutive quarter (-1.9% y-o-y, mainly on efficiencies achieved in the digitalisation process), allowing to reach the highest ever organic OIBDA margin (39.1%).

Revenues (€10,126m in 2018; +0.3%) returned to y-o-y growth in the quarter (€2,553m; +0.5%) after the fall seen in the previous quarter (-1.0%). This sequential improvement is mainly due to the better performance in prepay and the acceleration in broadband revenue growth. Stripping out regulatory impact, revenues would have grown by +1.9% in 2018 and by +2.1% in the quarter. Thus, OIBDA reached €4,311 in 2018 (+5.6%) and €979m (5.4% y-o-y in the quarter). OIBDA margin in Q4 was up, for the 8th consecutive quarter, 1.8 p.p. y-o-y to 39.1% in organic terms (37.2% organic in 2018, +1.9 p.p. y-o-y), the highest in Telefonica Brazil history.

CapEx in 2018 amounted to €1,910m (+2.4% y-o-y, 19% of operating revenues) and was mainly allocated to the expansion of the 4G network to 3,100 cities (88% of the population; +3 p.p. y-o-y) and to the deployment of the fibre and IPTV network. Operating cash flow totalled €2,401m in 2018, up 9.1% y-o-y.

Telefónica Hispam Sur: strengthening sustainable growth in a very competitive environment. T. Hispam Sur closed 2018 with a significant increase in OpCF (+8.3% y-o-y) supported by strong growth in higher value accesses and efficiency measures implemented in the region, despite the environment (which remained highly competitive, mainly in Peru) and sustained investment efforts in fibre and 4G networks expansion.

Revenues amounted to €6,677m in 2018 (+9.6) and to €1,988m in Q4 up by 11.1% y-o-y on growth in value and gradual tariff updates in Argentina. OIBDA rose to €1,719m in the year (+8.1%) and €483m in the quarter (+7.4% y-o-y). Quarterly OIBDA margin stood at 25.7% January-December (-0.4 p.p. y-o-y) and at in 24.3% in the fourth quarter (-0.9 p.p. y-o-y).

CapEx totalled €1,116m in 2018 (+8.0% y-o-y), representing 16% of operating revenues (excluding spectrum), stable y-o-y, despite the deployment of fibre, the increase in quality and 4G coverage and the launch of Pay TV service in Argentina.

Telefónica Hispam Norte: growing in high value customers. In Hispam Norte, quarterly results were still significantly impacted by regulation and competitive intensity, mainly in Mexico, although it is worth highlighting the positive results in Colombia. The good commercial trend in the region is also notable, with y-o-y growth in accesses in main products (contract, LTE, prepay, FBB, fibre and pay TV).

Revenues (€4,075m) fell 1.2% in 2018. Revenues in the quarter decreased by 2.4% y-o-y (€1,037) impacted by regulation (-1.6 p.p. in Q4; -1.9 p.p. in 2018) and by tariffs reductions in the Mexican market as a consequence of the highly competitive environment. OIBDA stood at €45m in the fourth quarter after registering a total write-off of the goodwill allocated to T. Mexico (€242m; €350m in 2018) in Hispam Norte’s “other companies and eliminations” (impact was registered at the holding company level). Organic OIBDA margin stood at 27.8% (-4.4 p.p. y-o-y; 27.4% in 2018, -2.3 p.p. y-o-y).

CapEx amounted to €668m in January-December (-26.8% y-o-y) and was mainly allocated to fixed and mobile network expansion. Additionally, in the quarter, €135m was registered for the acquisition of 40MHz of spectrum in the 2.5 GHz band and for the partial spectrum renewal in the 1,900MHz band in Mexico. CapEx (excluding spectrum) accounted for 13% of revenues (-4 p.p. y-o-y). Operating cash flow (OIBDA-CapEx) rose 17.9% in comparison to 2017.

[1]Guidance for 2019:

- Assuming constant exchange rates of 2018 (average in 2018) except for Venezuela (2018 and 2019 results converted at the closing synthetic exchange rate for each period), excludes the hyperinflation adjustment in Argentina and considering constant perimeter of consolidation.

- Does not include:

- Write-offs, capital gains/losses from the sale of companies, material non-recurring impacts and restructuring costs.

- The impact of the adoption of IFRS 16.

- CapEx excludes investments in spectrum.

2018 adjusted bases: Revenues (48,814M€) and OIBDA (15,879M€)

- Considering:

- Average exchange rates in 2018 with the exception of Venezuela (synthetic exchange rate upon the close of each period).

- Does not include:

- Write-offs, capital gains/losses from the sale of companies, material non-recurring impacts and restructuring costs.

- The hyperinflation adjustment in Argentina.

- The Results of the operations of Telefónica in Guatemala, Catsa and Antares.

[2] The adoption of the corresponding corporate resolutions willbe poroposed in due course, announcing the specific payment dates.

From left to right: Ángel Vilá, Chief Operating Officer of Telefónica; José María Álvarez-Pallete, Executive Chairman, Telefónica; and Laura Abasolo, Chief Finance and Control Officer, Telefónica

José María Álvarez-Pallete, Executive Chairman, Telefónica