Eduardo Salido,

Eduardo Salido,

2016 is a year that will be remarked upon in the next generation (digital) textbooks. The possibility of Brexit, the rise of populism and extremist political parties in Europe, the refugee crisis and the never-ending economic stagnation of the European economy may make us lament our choices in the near future.

We might also remember 2016 as the year we looked at the precipice, and decided that to cross the abyss it is better to use a bridge than try to jump it. Not all the issues we face are so decisive as Brexit or our migration policy. But there are still many economic challenges in Europe we must embrace sooner rather than later. Bold economic policies will make Europe a better place for everyone, including the Brits if they decide to Bremain and the migrants if we decide to bring them in.

Despite all these risks, recent macroeconomic figures show a good economic performance for a number of European countries. In 2015 the Irish economy grew at a stunning 7.8%[1]. The Spanish economy grew at 3.2% and the Portuguese at a more modest 1.5%. All these economies suffered deep recessions in the previous years.

I remember when in the most difficult times of the economic crisis, in 2011 and 2012, every politician or businessman was highlighting any piece of good news as green shoots. Today some flowers have grown from those shoots. Job and Talent, one of world’s leading job marketplaces just raised $42m. CartoDB, another Spanish-born startup which creates amazing data-driven customized visualizations, raised $23m for a total funding of $31m. Cabify, the Spanish Uber and a unicorn in the making, is now valued at more than $300m and recently raised and additional round C of funding worth $120m.

Europe’s performance in terms of new business creation is much better than many people think. According to Eurostat, 2.3 million new enterprises came to life in the EU in 2012 alone, creating around 3.5 million new jobs. And in 2014 – the latest year for which statistics are available – there were more enterprise births than deaths in Europe. Many policymakers across Europe have embraced entrepreneurship and put in place ambitious programmes to help local entrepreneurs start new businesses.

Are all these efforts enough for the European economy? From an employment perspective we see many European economies struggling to reduce unemployment rates. 10% of the Irish working population remain unemployed, despite the strong economic performance of the Celtic Tiger. Spain accounts for almost 4 million unemployed, who represent 20% of the labour force and Italy and Portugal unemployment rates are around 12%. All these figures suggest there is room for policies to be implemented, particularly on the supply side.

When in 2013 the Leaders Club[2] proposed the creation of the European Digital Forum in their Startup Manifesto, everyone agreed that Europe should bring back that entrepreneurial spirit, apparently lost in a dark night [and full of terrors] to the hands of those White Walkers called: Financial and banking crisis, austerity, real estate bubble and all sorts of economic imbalances. Europe needed to create more innovative, cutting edge technology-driven companies.

Almost three years after the launch of the Startup Manifesto we have seen startup accelerators mushrooming all across Europe[3]. Startups occupy more and more headlines in the media and entrepreneurs are becoming role models in today’s modern societies. Another piece of good news is that startups are now the backbone of the innovation strategies for many European corporations. It seems everyone has taken startups seriously. Now the time has come to embrace scaleups.

We seem to be taking steps in the right direction to cultivate Europe’s financial and entrepreneurial spirit; so what could we do to improve the impact of venture capital on Europe’s entrepreneurial renaissance?

Currently, in the VC industry, we are faced with the US dominating the playing field, followed by Europe (and then China). However, Europe is indeed the second largest hotbed in the global VC ranking and it is in a strong position to compete globally with the US VC’s more intensively, particularly in those phases where European funds do not perform in the same manner as the American’s.

The problem lies in the fact that although the European start-up ecosystem is healthy and has significantly increased in size over the past few years, non-European investors seize the mature investment opportunities. It is our dominant VC partners over the pond that are acquiring main European scale-ups and indeed, the US is the leader when it comes to invest in European tech companies. As positive as this may be in terms of the foreign investment flows, it does mean that European investors are lagging behind and missing out on potential benefits in their own markets.

Although foreign investment is a sign of strength in any economy, we must admit that European capital is losing a massive opportunity in the VC arena with a mere representation of 15% of global VC activity – in comparison to the US’ 68%.

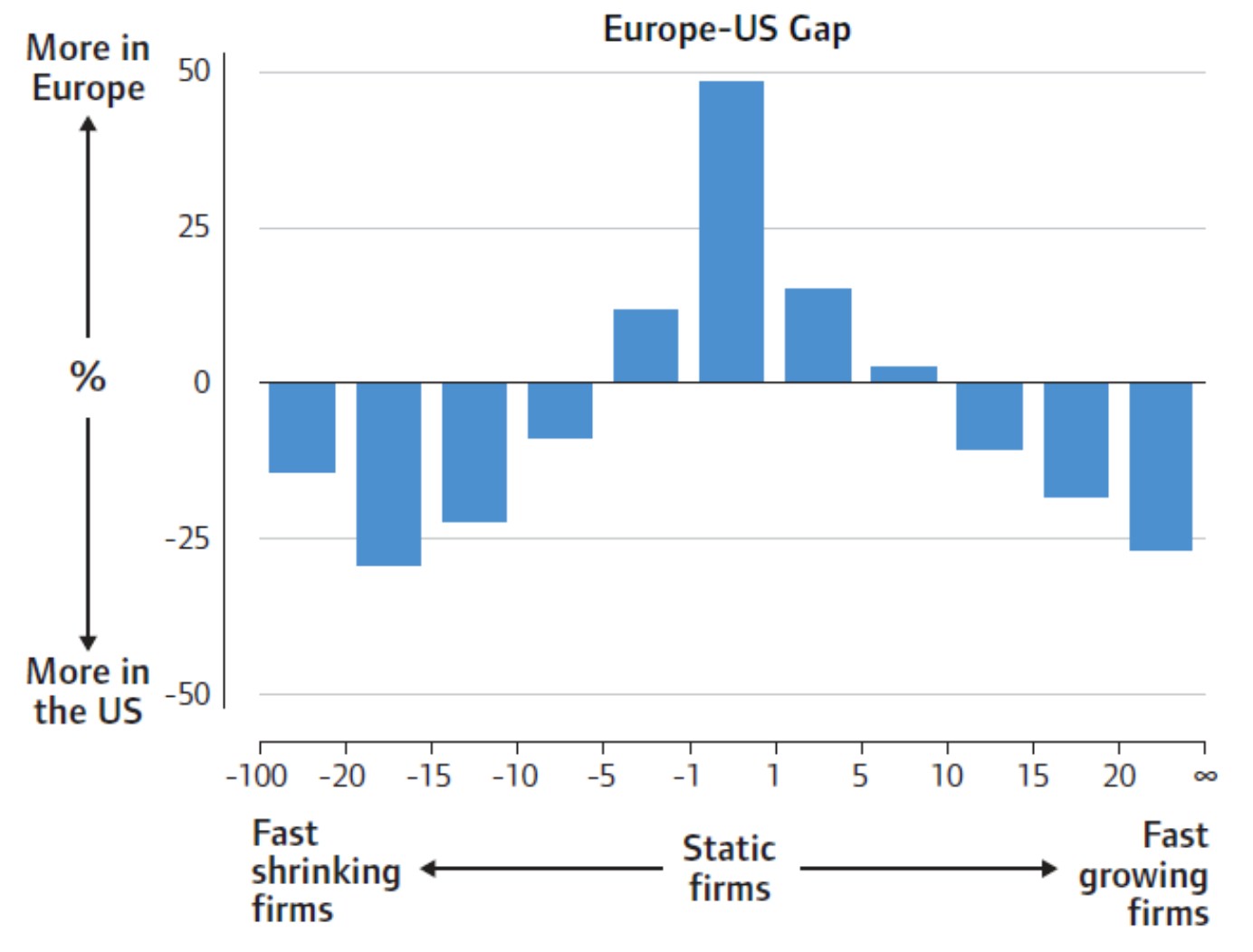

The Digital Single Market strategy launched by Vice President Ansip a year ago, aims to make Europe a place in which digital companies can grow and thrive. In the paper “From Startup to Scaleup: Growing Europe’s Digital Economy” Sergey Filippov and Paul Hofheinz identify the main issues of the European digital business ecosystem: European countries have both fewer growing and fewer shrinking firms in comparison to the U.S. In contrast, Europe has a much larger share of firms that remain static.

Another feature of the European digital ecosystem is a feeble investment environment where startups need to find the fuel they need for growth. Invest Europe estimates the total amount of venture and other forms of growth capital raised in 2015 at €47.6 billion. Venture capital, accounted for €5.3 billion, only 11.1% of the total annual amount. Nonetheless, this was the highest level reached since 2008. In 2015, fundraising for early-stage-focused funds increased to €2.7 billion, up by 13%, while later-stage fundraising nearly tripled to €870 million. Actual venture-capital investments increased by 5% but still constituted a mere €3.8 billion, even less than the venture capital rose that year.

The following Decalogue of policy measures and initiatives should be implemented, for the broken funding escalator in Europe to be repaired:

- The European Union and the European Investment Fund should increase investment alongside EU member states in a large public-private venture capital fund of funds.

- European initial public offering markets need to become significantly more accessible to promising, high-growth firms. Creating dedicated high-growth segments of European stock exchanges, tailored to the needs of these firms, as well as more flexible alternative segments, could have great impact and become part of the solution.

- Corporate and institutional investors should channel more finance into venture capital and other growth-based funding. This could be done through greater public-private partnership, using state guarantees to encourage co-financing on key projects from sources as multifarious as pension funds, sovereign wealth funds and social investments. This would require a better national and European incentive structure, including improved information about opportunities.

- The European Commission should improve communication and public awareness of Europe’s rising stars. One good initiative could be a “Future 100 Europe” programme, modelled on the United Kingdom’s Future 50. In this programme, European companies would compete to receive funding and mentoring from larger, more established firms.

- End tax discrimination for equity investment. EU member states should drop punitive front-loaded taxes on equity options – not just because “Europe” asked them to but because it’s in their interest that they do so. Tax systems should be adjusted to treat the choice between debt and equity more neutrally. Startups should be able to use stock-option packages to attract and retain talent.

- At the European level, the European Commission and EU member states should work jointly to complete the single market and the capital markets union. A good starting point would be improved business insolvency legislation. A harmonized regulatory framework should allow quick bankruptcy, making it easier for those in need to “fail fast” and offering a second chance to many worthy entrepreneurs.

- Give a stronger role to the European Fund for Strategic Investments (EFSI), and to digital startups within it. Regarding EFSI, we believe it could serve as a model in future EU budgets, helping the EU move from a traditional grant-based method of funding projects to a more effective investment-led model, which would “crowd in” funds around well-vetted projects. The EFSI has been a success in that regard, bringing funding into relatively risky areas that might easily have been overlooked.

- Set up a platform-based information hub and database of promising companies, integrated with the European Investment Advisory Hub (EIAH) and the European Investment Project Portal (EIPP). Its core element would be a pan-European database of EU high-growth firms in different sectors, chosen on objective and transparent criteria, allowing cross-company comparison and benchmarking. In particular, the hub would include a list of companies in their pre-IPO phase.

- Build a broader investment tool kit to promote and stimulate growth-stage investment. Among the options that should be considered are greater use of so-called “asymmetric funds,” which deliver varying returns to different classes of asset holders (widespread on the Israeli tech scene) and alternative finance vehicles, such as crowdfunding.

- Startups should themselves be more vocal, banding together to provide better, more coherent recommendations to policymakers at the national and European level. A good place to begin would be with a “Scale-Up Manifesto,” a hard-hitting set of policy proposals written by leading entrepreneurs. It should look at the concrete problems of scaling small companies and propose concrete solutions for resolving the bottlenecks.

Bold, data-driven policies and an army of entrepreneurs are the Dragonglass and the Valyrian steel[4] to avoid the victory of the European White Walkers.

[1] European Economic Forecast 2016, DG ECFIN’s, European Commission.

[2] About the Leaders Club: The Leaders Club is an independent group of founders in the field of tech entrepreneurship, who act as role models for European web entrepreneurs and provide guidance to the Commission on what needs to be done to strengthen the environment for web entrepreneurs to start in Europe and stay in Europe. Source: European Commission, https://ec.europa.eu/digital-single-market/en/leaders-club.

[3] Eduardo Salido, Marc Sabás and Pedro Freixas. The Accelerator and Incubator Ecosystem in Europe (Brussels: Telefónica, 2013)

[4] Game of Thrones note (contains spoiler): For those non-initiated in the HBO TV series broadcasted by Movistar in Spain. Dragonglass is a common name in Westeros for the substance known as obsidian, a form of volcanic glass. Along with Valyrian steel, it is one of the two known substances capable of killing White Walkers. White Walkers are, in short, the bad ones.