- Telefónica demonstrates its management efficiency and financial strength during the pandemic with cash generation of €4,794 million for the full year.

- The company shows a progressive improvement both in commercial and operational activity in the last quarter of the year, with revenues of €10,909 million.

- The Group cuts net financial debt by over €2,500 million in 2020. Since mid-2016 it has been reduced by €17,000 million.

- Telefónica will propose to the next AGM the shareholder remuneration policy for 2021, a voluntary scrip dividend of 0,30 euros per share.

- Telefónica increased its total volume of accesses to 345.4 million, in a year marked by greater customer satisfaction and loyalty.

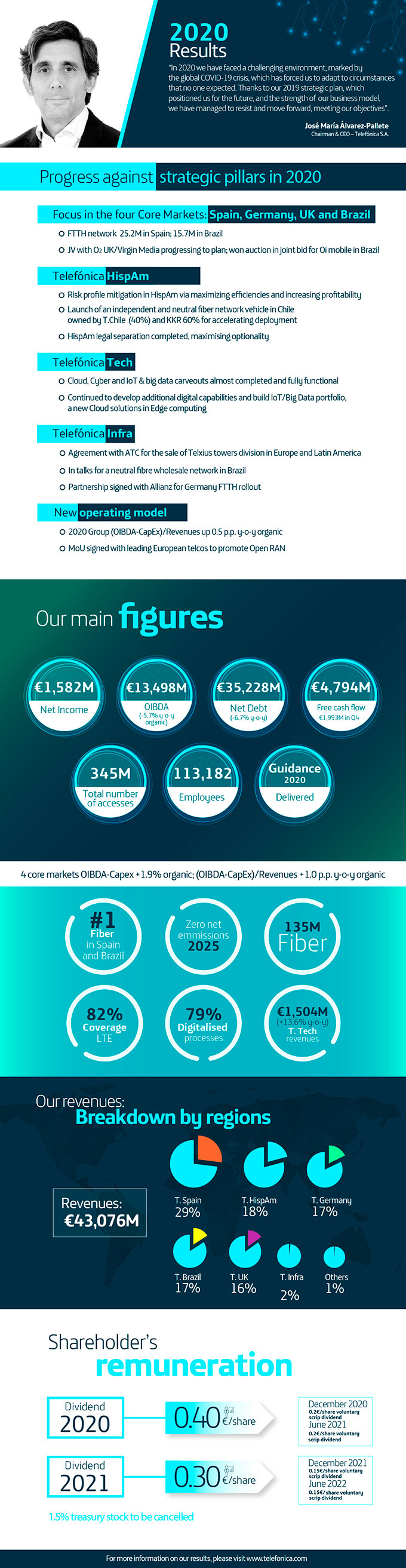

Madrid, 25th February 2021 – Telefónica reported a net income of €1,582 million in 2020, 38.5% up vs. the previous year. This result demonstrates the company’s management efficiency to overcome the difficult conditions caused by the pandemic. Also shows its capacity of transformation to mitigate its effects, which has allowed Telefónica to end the year with a clear operational improvement. Between October and December, net income reached €911 million, the highest in a single quarter since the first three months of 2019.

“2020 has been a strange year, a year in which we have been challenged. A lot was expected of Telefónica and Telefónica has lived up to these expectations. We have been side by side with the rest of society, where we had to be. We have delivered and we have continued to make progress. These figures are the result of the guidelines we set in the 2019 strategic plan, which left us well prepared for the unexpected. They are also the result of the correct measures adopted to activate an effective and precise management in a very complex environment. We had to act, we did, and the results now tell us that we were right,” said Telefónica’s Chairman and CEO, José María Álvarez-Pallete.

The good progress of the results throughout the year was confirmed by cash generation. While in the first six months it was limited to €1,222 million, in the second half it increased to €3,572 million, to reach a total of €4,794 million for the year as a whole. In the last quarter of 2020, free cash flow reached €1,993 million, 13.2% more vs. the same period of 2019. This increase meant that the annual figure was in line with the average for the last five years, a period in which Telefónica has generated total cash of €25 billion.

The Group’s capacity to generate cash has allowed a substantial reduction in the company’s indebtedness. Between October and December, Telefónica’s net financial debt fell by €1,449 million, and by €2,516 million for the year as a whole. As a result, net debt ended 2020 at €35,228 million, a volume that does not include the €9,000 million (25% of current net debt) from inorganic operations pending completion. Out of those operations it is worth highlighting the merger of O2 and Virgin Media in the UK and the sale of the Telxius towers. This additional amount will give Telefónica greater optionality and financial capacity to continue reducing its debt. In the last four years, the company has cut its net debt by approximately €17,000 million euros, almost 30% since mid-2016.

As an important reinforcement within the complex financial environment caused by the pandemic, Telefónica continues to have a solid liquidity position. At the end of 2020, it amounted to €21,447 million, sufficient to cover maturities of the next two years.

Progressive improvement in revenues

Revenues also reflect the greater dynamism recorded in the last months of the year, mainly driven by the growing commercial and operational activity in its four main markets: Spain, Germany, Brazil and the UK. Between October and December, revenues stood at €10,909 million, just 2% lower organically vs. the same period of 2019. This result consolidates the improvement of quarterly revenues, given that in q3 y-o-y it decreased 4.3% and in q2 it was down 5.6%. For the whole year, revenues reached €43,076 million, 11% less vs. 2019, impacted by currency devaluation and COVID-19. In organic terms, revenues declined to 3.3%, and to 2.4% for the four most important markets.

By countries, Spain accounted for 28.8% of revenues; Germany, 17.5%; Brazil, 17.2%; and the UK, 15.6%. As a result, the four markets account for 79.1% of revenues. Telefónica Hispam contributed 18.4% to global revenues.

Operating income before depreciation and amortisation (OIBDA) reinforced the favourable progress achieved at the end of the year. It reached €3,751 million in the fourth quarter, 2.2% more vs. the same period of 2019. Year-to-date, OIBDA stood at €13,498 million, 10.7% lower than 2019, a decline that is reduced to 5.7% in organic terms.

Operating cash flow (OIBDA – CapEx) recorded a notable increase both quarter-on-quarter and year-on-year. This responds, first, to the progressive recovery of business performance and, second, to the measures taken to manage CapEx according to the situation generated by the pandemic. In the last quarter, OIBDA – CapEx climbed to €1,957 million, 26.9% more vs. the partial end of 2019. For the year, it reached €7,637 million, 20.5% higher vs. 2019. In this area, Brazil and the United Kingdom stand out, where operating cash grew organically by 8.5% and 2.7%, respectively, compared to previous year.

Telefónica Tech completes the carve-out and strengthens growth

During the past financial year, Telefónica Tech, one of the key units created in the strategic plan presented in November 2019 to build the New Telefónica, confirmed its growth story.

Telefónica Tech is already a reality after completing the carve-out process, delivering on the announced road map.

The pandemic reinforced the need to accelerate digital transformation by having the precise security tools so to maintain business activity and services. For this reason, solutions provided by Telefonica Tech (Cybersecurity, Cloud and Big Data and IoT) were more in demand. As a result, Telefónica Tech’s revenues kept reporting a double-digit growth. They increased by 13.6% in the full year to €1,504 million, almost tripling the market.

“Telefónica Tech is synonymous with growth. With this idea in mind, it was launched in the 2019 strategic plan, and with this determination already faces its future as a fully operational and autonomous unit. Telefónica Tech is an example of Telefónica’s capacity for anticipation and innovation, counting with its services and solutions, as a key lever to drive companies’ digital transformation and to capture the opportunities of the current technological revolution,” said Álvarez-Pallete.

Led by Jose Cerdán as CEO, Telefónica Tech reinforces its management structure with the appointment of Pablo Eguirón as Chief Financial and Corporate Development Officer (CFCDO). Until now, Eguirón was Telefónica’s Global Head of Investor Relations.

Adrián Zunzunegui, currently part of the Investor Relations’ team and with extensive experience in the financial markets, assumes the responsibility of leading this area.

Telefónica Infra continues fulfilling its mission

Telefónica Infra, also launched in the 2019 plan, has reported a positive performance in 2020. In the last quarter of the year, revenues grew by 4.7% to €217 million. For the full year, Telxius’ revenues grew organically 1% to €826 million.

At the same time, Telefónica Infra has fulfilled its mission to crystallise the value of the company’s telecoms infrastructure and the search for new opportunities with several large deals in recent months. In October it launched a joint venture with Allianz to roll out fibre in rural areas of Germany and in January it sold Telxius towers to American Tower Corporation in a deal at record multiples.

Building the New Telefónica

These operations show how the company is delivering on the execution of its strategic plan to build the New Telefónica. Activity has been continuous in this area. In May last year, in full lockdown and with all teams fully working from home, Telefónica closed the biggest corporate deal in its history: the joint venture of O2 and Virgin Media. In September, Telefónica switched on 5G and had 80% of the Spanish population covered in just three months. In December, Telefónica closed with its partners the purchase of Oi’s mobile assets in Brazil, strengthening its leadership in a key global market.

According to plan, exposure to Hispam has been reduced, and efficiencies and profitability have also been maximised. Advancing in this policy, the sale of 60% of Infraco to KKR was announced this week, an operation that allows the company to monetise part of its fibre in Chile. Telefónica Chile will hold the remaining 40% of the capital. Infraco was created with the aim of increasing the number of premises passed by fibre to 3.5 million by 2022 from the current two million and contribute to the democratisation of fibre access in the country.

Shareholders remuneration and guidance

On the other hand, Telefónica will propose for approval to the next AGM the shareholder remuneration policy for 2021, a voluntary scrip dividend of 0,30€ per share, to be paid in December 2021 (0,15€ per share) and in June 2022 (0,15€ per share). This decision allows Telefónica to continue with the company’s transformation, investing in higher growth potential areas, reallocating resources to capture these opportunities, improving capital structure and maintaining an attractive shareholders’ remuneration.

Both Telefónica’s Chairman and COO, José María Álvarez-Pallete and Ángel Vilá, respectively, have waived 100% of their long-term incentive remuneration for the year.

Regarding 2021 guidance, Telefónica expects stabilization trends in revenues and OIBDA, as well as normalisation in the level of CapEx/Sales up to 15%.

More customers and more loyal

In 2020, Telefónica continued to attract and retain high-value customers. During the past year, the group increased its access base by 0.3%, to a total of 345.43 million. The company’s high-speed network (fibre and cable) totalled 134.8 million premises passed, 9% more vs. 2019, of which 61.8 million premises corresponded to the Group’s own network, 11% more vs. a year earlier.

Telefónica’s leadership in infrastructure and services translated into more satisfied customers. The Net Promoter Score (NPS), which measures customer satisfaction, closed the year at 24% in the four main markets, 7 percentage points higher than the previous year. This increase is reinforced by a decline in the customer churn rate, which fell 0.7 percentage points from 2019 to 2.3%. This is the fourth consecutive quarter of improved customer loyalty.

Leading digitisation

The Group’s digital transformation programme continues to play a key role in improving customer experience and service quality, as well as in delivering efficiencies.

Telefónica’s business processes already digitised, and managed in real time, accounted for 79% of total processes in 2020, an increase of 10 percentage points year-on-year. In addition, the company made significant progress in digitisation during the year, with digital sales in the Group’s four main markets increasing by 40.5% year-on-year to 31% of total sales.

Commitment to sustainability

The increase on net income, cash generation and debt reduction, within an operating activity upturn context in the final months of 2020, represent the main milestones of this results, demanded by the impact of the pandemic. During the past year, and in addition to the measures required to deal with such a delicate scenario caused by COVID-19, Telefónica also made a commitment to society and to its stakeholders. The company set initiatives aimed at combating the impact of the disease by providing healthcare material, equipment and alleviating the effects on the most disadvantaged providers and individuals. All initiatives were set within the company’s objective of promoting fair, inclusive and sustainable digitalisation.

As a result of these efforts, in 2020 Telefónica helped companies save 9.5 million tonnes of CO2, equivalent to the carbon captured by 158 million trees. In addition, the company brought forward its goal of zero net emissions to 2025. “Telefónica has fulfilled its purpose and has kept life connected. Now is the time to accelerate, to continue to excel in order to create and lead the new future”, concludes José María Álvarez-Pallete.

Related documentation

PRESENTATION OF Q4 2020 RESULTS

PRESENTATION OF Q4 2020 RESULTS

Shareholders and Investors Section

QUARTERLY RESULTS

QUARTERLY RESULTS

Here you have data about the conference call, in which the most significant aspects of the results are commented.

Other news of interest