- Free cash flow reached €842 million in the second quarter, doubling that of the first quarter of the year.

- Telefónica maintains its international leadership in technology and network deployments, with more than 169 million premises passed with UBB networks and a high 5G coverage in its core markets.

- “Telefónica is moving towards a new vision of the company with its 2023-2026 plan, a new model of operational excellence based on three pillars: Growth, Profitability and Sustainability,” said José María Álvarez-Pallete, Chairman of the company.

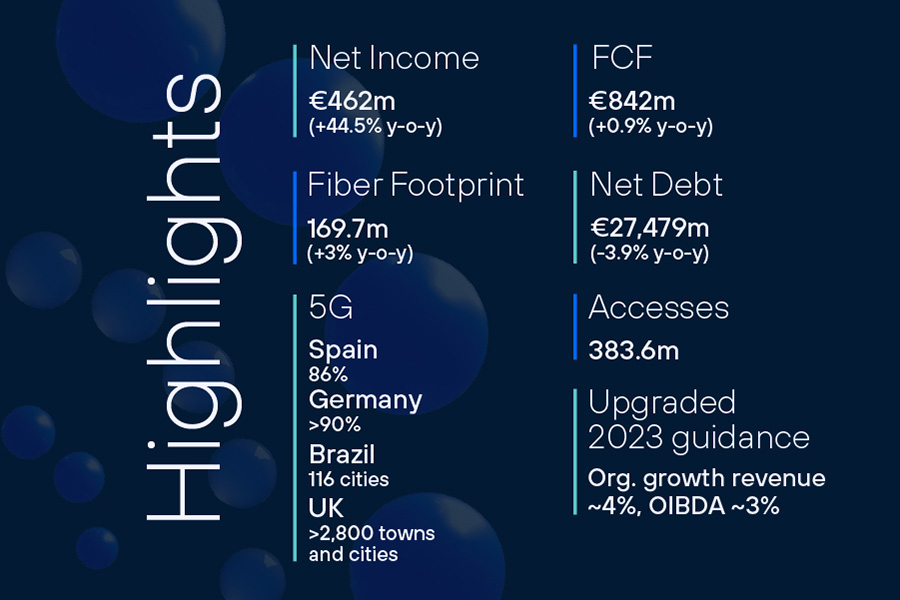

Madrid, 27 July 2023. Telefónica accelerated growth during the second quarter of the year reaching a net income of €462 million, 44.5% more compared to the same period of 2022. Revenue rose 0.9% to €10,133 million between April and June this year and confirmed its favourable progression by growing for the fifth consecutive quarter.

This positive business performance allows Telefónica to upgrade the financial targets set for 2023: revenue target is being doubled anticipating a 4% organic growth, while the new target for operating income before depreciation and amortisation (OIBDA) aims for a 3% organic increase, in the higher range of the guidance announced at the beginning of the year. The target for the CapEx to sales ratio of around 14% remains unchanged.

The upgrading comes after presenting organic growth in revenues and OIBDA in the second quarter, by 3.3% and 3.5%, respectively. For the first half of the year, Group’s revenue and OIBDA grew organically by 4.1% and 2.3%, respectively. The ratio of CapEx to sales stood at 12.7%.

This results also allow Telefónica to confirm the distribution of the 2023 dividend of 0.30 euros per share, payable in two tranches: in December 2023 and June 2024. In addition, the company will propose to the next General Shareholders’ Meeting the cancellation of the shares representing 1.4% of the share held as treasury stock at 30 June 2023.

Telefónica is moving towards a new vision of a company focused even more on the best customer service and the creation of shareholder value with the most disruptive technology to take advantage of all the growth opportunities of the future. The company will present a new strategic plan for the period 2023-2026 at an Investor Day on 8 November.

“Telefónica accelerated in meeting its objectives during the second quarter and confirms the strength of the business and the good momentum of the company, which allows us to upgrade our guidance and renew our ambition to move towards a new vision for the company,” said Chairman José María Álvarez-Pallete. He adds: “Focused on the customer and the creation of shareholder value, and with technology as a decisive factor to better understand and connect with the world, Telefónica is preparing its 2023-2026 plan with a model of operational excellence based on three pillars: Growth, Profitability and Sustainability. The operator is in an advantageous position to capture all the growth opportunities of the digital era. Telefónica is not content to simply adapt to the future but has decided to shape it with a radical evolution. The new times catch us well prepared to anticipate, respond and complete the challenging journey we undertook almost a hundred years ago. Our time has come. It is Telefónica’s time. We are ready for the future”.

Higher revenue

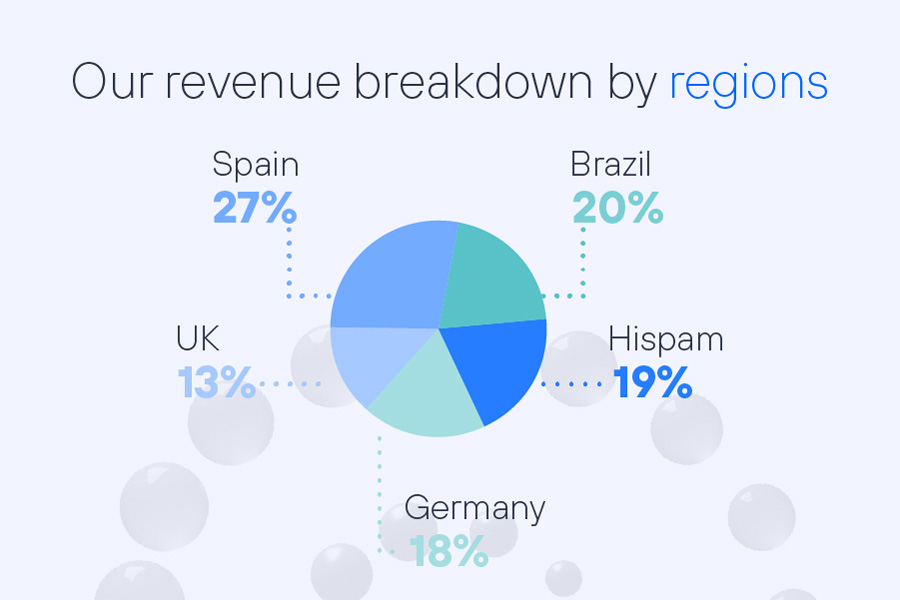

Revenue grew to €20,178 million in the first half of the year, 3.7% more than in the first six months of 2022. By markets, 27% of revenue came from Spain; 20% from Brazil; 19% from Spain, 19% from Hispam; 18% from Germany; and 13% from the United Kingdom.

OIBDA stabilised at €3,144 million in the second quarter and reached €6,266 million in the first half of the year. By geographies, 30% of OIBDA came from Spain, 26% from Brazil, 17% from Germany, 14% from the UK and 11% from Hispam.

Free cash flow generation in the quarter amounted to €842 million, almost doubling that of January-March 2023 and 0.9% higher than in the same period of 2022. The cumulative figure for the first six months reached €1,296 million.

Operating cash flow (OIBDA-CapEx) also evolved positively, showing that the company has left behind its biggest investment cycle. This figure grew organically by 3.4% in the second quarter and by 2.7% in the first half of the year, thanks to the operating performance and the continued management of investment levels.

Strong momentum of the strategic units

Telefónica Tech reported revenues of €456 million in the quarter, 36.1% more than in the second quarter of 2022, and €885 million in the first half, up 39.6%. These figures confirm that it has ended the quarter revalidating its above-market growth rates, as well as its leadership position as a provider of new generation solutions thanks to its scale and differential capabilities.

Telefónica Infra continues to boast a leading infrastructure portfolio, with a presence in fibre, data centres and submarine cable. The various fibre vehicles, present in Spain, Germany, the UK, Brazil, Chile, Colombia and Peru, reached a total of 19 million premises passed. Telxius, the Group’s submarine cable business, ended the first half with a 16% increase in traffic, organic OIBDA growth of 5.1% and an OIBDA margin that continued to rise to 53.3%.

Well protected financing and less debt

Telefónica’s financing activity up to June has enabled the company to maintain a liquidity position of €20,218 million, to cover maturities for the next three years and to have an average debt maturity of 12.4 years. In addition to these references, the company is well protected against the current context of tightening monetary conditions with more than 80% of its debt at fixed rates.

Net financial debt amounted to €27,479 million at the end of June, 3.9% lower than in the same period of 2022.

Technology leadership and network deployment

Telefónica’s customer base of 383.6 million accesses grew strongly in high value added segments, such as fibre (+15%) and mobile contract (+3%).

The constant transformation of Telefónica’s networks, is focus on the unbundling and softwarisation of the network architecture, on customer needs, on meeting sustainability targets and on privacy and security, and has enabled the acceleration of fibre and 5G deployments as well as the planned switch-off of the copper network in Spain by April 2024.

The company maintained its leadership in fibre at the end of June, with a total of 169.7 million premises passed with UBB networks (+3%). Of these, a total of 68 million are FTTH (+14%).

5G coverage reached 86% of the population in Spain at the end of the second quarter, more than 2,800 towns and cities in the UK, more than 90% of the population in Germany and 116 cities in Brazil.

Progress on sustainability

In the second quarter, Telefónica also continued to make progress in its environmental, social and corporate governance pillars.

In the environmental area, including the entire value chain, the company committed in the quarter to recovering at least 20% of the mobile handsets sold through its own channels by 2030, recycling all of them and promoting their reuse, in line with the initiative promoted by the GSMA. In Brazil, Telefónica has commissioned 8 Distributed Generation plants, bringing the total number of operational plants to 59 out of the 85 planned by the company.

From a social perspective, Telefónica continues its commitment to connect more people in the countries in which it operates, reinforcing its commitment to digital inclusion. In terms of diversity, also a Group’s priority, the number of women executives is above 32%, and it is progressing towards its goal of reaching 33% by 2024. In addition, the Telefónica Foundation has boosted the employability of approximately 1.2 million beneficiaries during the first half of the year.

Finally, in terms of governance, Telefónica has launched a free service in Spain that has blocked more than 533 million cybersecurity threats in one year. In addition, GlobalCapital has recognised Telefónica as ‘The Most Impressive Corporate Hybrid Bond Issuer’ for the company’s hybrid capital management.