One planet isn’t enough; we need 1.7 planets to maintain our life style, our habits. In addition, the UN has warned us that there are only 12 years left to stop climate change.

Taking care of the environment is urgent and we can do it from many fronts. Companies are essential for reversing the situation, and there are already many that have started to work on the situation. Telefónica has been working on this for years and is now taking another step forward: issuing green bonds to improve energy efficiency.

Elena Valderrábano, Director Corporate Ethics and Sustainability, y Jesús Romero, Chief Financial Officer at Telefónica, talk in this video about the backstage of our green bond issue and the challenge that it means.

There are three keys placing the Company in the future thanks to these bonds. Let’s look at them:

SDG relationship

In order for the issuance to take place, it requires a prior framework in which the company demonstrates its solidity for said operation. The framework leading to these bonds is linked to the United Nations Sustainable Development Goals (SDGs) established for 2030 for the purpose of eradicating poverty, protecting the planet, and ensuring prosperity for all mankind. In fact, it’s called the Telefónica SDG Framework.

Within this framework, the multinational focuses on SDG 9, which consists in “building resilient infrastructures, promoting inclusive and sustainable industrialisation, and fostering innovation”. Because of its activity, communicating people, Telefónica has an impact through SDG 9, in other goals such as 4, 6, 7, 8, 12, and 13, transforming into an engine of progress.

Thus, under this Framework, the company can issue green, social, or sustainable bonds according to the projects to be financed.

“It has not been easy to circumscribe the emission to a project”, Elena Valderrábano

Long-term growth

Green bonds represent an opportunity for the company to have an impact on its long-term strategy. Hence the project chosen for this first issuance: increasing the company’s energy efficiency thanks to the transformation process from Copper to Optical Fibre in Spain.

The way Telefónica implements it, FTTH (Fibre To The Home) is 85% more energy efficient in customer’s access than Copper network. This has made it possible saving 208 GWh in the last three years, preventing the emission of 56,500 tons of CO2 into the atmosphere, equivalent to the carbon absorbed by more than 900,000 trees. In addition, the deployment of Fibre is allowing the company to shut-down a Copper exchange every day, recycling all the material as part of its commitment to circular economy.

“Investors really liked the initiative”, Jesús Romero

Interesting for investors

Investors find green bonds more appealing every day as a way to diversify their portfolios with profitability. They are aware that sustainability is increasingly important, and are thus attracted to environmental projects. This is why the demand for the Telefónica issuance exceeded its offer by a factor higher than five, €1 billion.

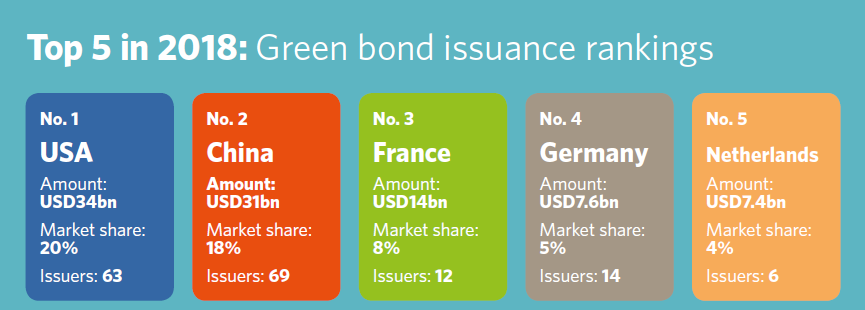

And the pressure to increase investment to take care of the planet is on the rise. Therefore, issuance predictions for 2019 range from $140 billion to $300 billion. In 2018, they totalled 167.6 billion. However, what is really needed is one trillion per year, says the Initiative Climate Bonds in its report “Green bonds: The state of the market 2018”.

The future is already here, and it’s green (or there won’t be any at all)!