Strategic Digital Autonomy

The concept of strategic autonomy is consolidated in areas such as defence and energy, but in recent years areas such as science and technology have also joined the debate on strategic autonomy. Security, defence, energy and technology have been at the centre of the debate on the necessary boost to European strategic autonomy in recent months.

The digital sphere has gained prominence, with proposals such as Eurostack, for the creation of European digital infrastructures. The European Commission’s State of Digital Decade report indicates that Europe is 80% dependent on digital technologies and services from third countries. In an area such as cloud services, Eurostack indicates that Amazon, Microsoft and Google account for approximately 70% of the European market.

In a recent speech, the European Commission’s director of Future Networks, Thibaut Kleiner, warned of the EU’s technological dependence on large non-European companies, as well as high spending on digital products developed outside Europe.

Despite growing concerns about digital dependence, especially with regard to cloud computing or artificial intelligence (AI), in a draft digital strategy leaked to the media, the EU admitted that it was unrealistic to reduce digital dependence on American tech giants.

The digital trade perspective on strategic autonomy

In this context, measuring European digital dependency provides some relevant magnitudes. Even if the figures provided by the European Commission itself (80%) are clarifying, the magnitudes of European digital trade with other countries can provide a clearer picture of European digital dependencies.

Digital trade provides a complementary perspective. However, measuring digital trade is not straightforward. This is why the study published by the Toulouse School of Economics, “Estimating digital product trade through corporate revenue data” makes a significant contribution.

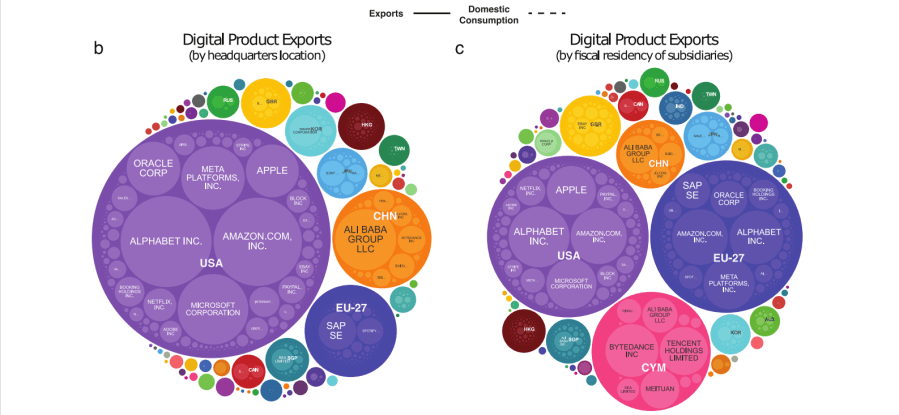

The “ Handbook on Measuring Digital Trade “, a publication jointly prepared by the OECD, WTO, UNCTAD and IMF, defines digital trade as all trade that is ordered and/or delivered digitally. Despite its undeniable importance, defining and measuring digital trade is complex, because much digital trade falls under what is known as “GATS Mode 3 trade”, which is trade conducted through physical presence in a foreign country. For example, a European citizen purchasing cloud computing services from Amazon is “importing” them from Luxembourg, not from United States.

This means that a large part of trade in digital products is not adequately reflected in digital trade statistics, according to the criteria currently used.

A new approach to measuring trade in digital products

In the Toulouse School of Economics study, “ Estimating digital product trade through corporate revenue data “, César A. Hidalgo, Viktor Stojkoski, Eva Coll-Martínez and Philipp Koch have generated estimates of digital trade by building a model using corporate revenue data and digital consumption patterns.

The study focuses on what they call “digital products” which refers to trade of digital goods (e.g. video games), services converted into products (e.g. digital advertising) and digital intermediation fees (e.g. hotel bookings). This definition leaves out physical products, even if they are purchased digitally. This figure describes the concept of digital product according to the Toulouse school study.

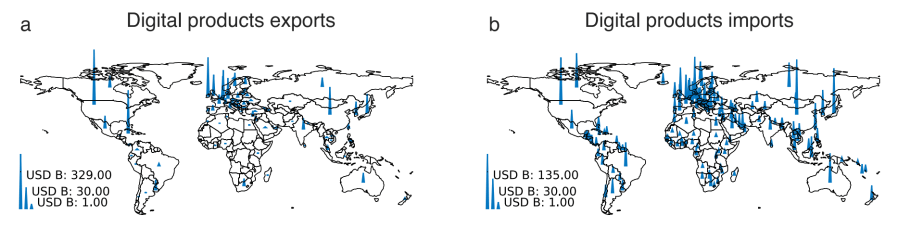

The methodology developed in the study allows you to identify which countries are importers and exporters of digital products. Purely importing countries will show high digital dependency and low strategic autonomy in the digital domain.

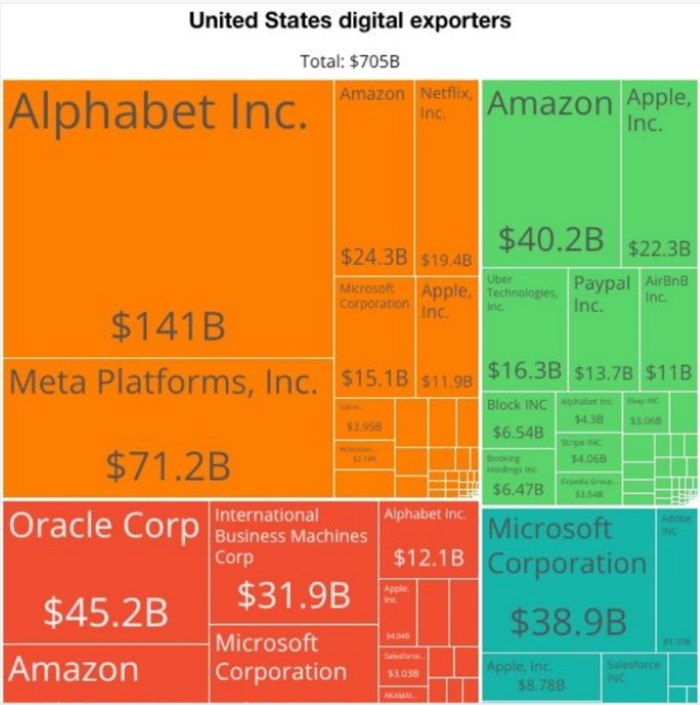

As might be expected, the findings of this study reveal strong US digital export activity, with billions of dollars exported in categories such as digital advertising, cloud computing and video on demand.

To put the digital trade figures in context, we can compare them with figures for exports of physical goods. As the authors of the study point out, the main physical goods exported by the United States today are crude oil and refined oil, with around $100 billion in exports/year in each category. Comparatively, US exports in digital advertising and cloud computing are approximately $260 billion and $184 billion, respectively, according to the study.

In other words, the United States’ main exports of digital products are much larger than its main exports of physical goods. Silicon Valley would be the main export hub of the United States.

The same study shows European countries as major importers of digital products. The reality reflected in the Toulouse School of Economics study offers another perspective on Europe’s dependence in the digital sphere. One more element for reflection in the essential debate on the objective of Europe’s strategic digital autonomy.