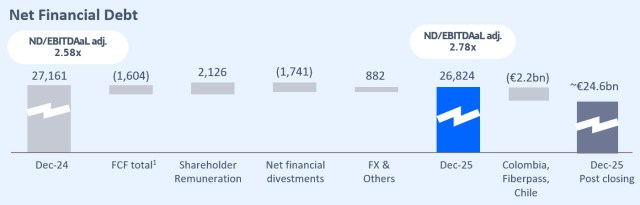

Debt evolution

(1) Total FCF (continuing and discontinued operations) including spectrum payments.

Net financial debt and commitments

Unaudited figures (Euros in millions)

| December 2024 | December 2025 | |

|---|---|---|

| Non-current financial liabilities | 33,192 | 30,120 |

| Current financial liabilities | 5,590 | 4,219 |

| Gross Financial Debt | 38,782 | 34,339 |

| Cash and cash equivalents | (8,062) | (6,564) |

| Current financial assets | (1,789) | (861) |

| Non-current financial assets | (3,698) | (3,980) |

| Mark-to-market derivatives adjustment (1) | 383 | 736 |

| Other current assets and liabilities | (262) | 1,097 |

| Other non-current assets and liabilities | 1,807 | 2,057 |

| Net Financial Debt | 27,161 | 26,824 |

| Lease Liabilities | 8,275 | 7,920 |

| Net Financial Debt including Lease liabilities | 35,436 | 34,744 |

Notes:

(1) Includes the market value of cash flow hedges related to debt instruments and the market value of economic hedges associated with gross employee benefit commitments.

Financing activity

In 2025, Telefónica Group raised long term financing by €7,862m and VMO2 raised €6,299m equivalent.

Financing activities in Q4 25 included:

- In Nov-25, Telefónica signed a €100m bilateral loan (maturity in Nov-32).

- In Jan-26, T. Emisiones launched a €1,750m green hybrid bond (structured in two tranches; €900m (5.25 years reset date) and €850m (8.25 years reset date)). The Company launched a tender offer for the purchase of existing hybrid bonds with first reset dates in Sep-26, May-27 and Nov-28. T. Europe B.V. accepted the purchase in an aggregate principal amount of €1,538m. On Feb-26, we have exercised the option to redeem the €212m outstanding of the hybrids with first non-call dates in Sep-26 and Nov-28.

- In Feb-26, Telefónica closed the issuance of a senior bond in the Swiss franc market of CHF170m (8 years maturity and 1.5075% annual coupon) and T. Emisiones closed a €1,000m green bond (7.25 years maturity).

Telefónica financing activity has allowed to maintain a solid liquidity position of €17,432m (€10,007m of undrawn committed credit lines; €9,667m maturing over 12M). As of Dec-25, the Group has covered debt maturities over the next three years and the average debt life stood at 10.9 years.

Telefónica and its holding companies continued their issuance activity under the Promissory Notes and Commercial Paper Programmes (Domestic and European), maintaining an outstanding notional balance of €1,245m as of Dec-25.

Financial debt

Total Financial Liabilities Breakdown

Unaudited figures (Euros in millions)

| December 2025 | |||

|---|---|---|---|

| Bonds and commercial paper | Debt with financial institutions | Other financial debt (including governments) and net derivatives | |

| Total financial liabilities (1) | 79% | 6% | 15% |

(1) Includes positive value of derivatives and other financial debt

Net financial debt plus Lease Liabilities structure by currency

Unaudited figures (Euros in millions)

| December 2025 | ||||

|---|---|---|---|---|

| EUR | BRL | HISPAM | OTHER | |

| Net financial debt plus Lease Liabilities structure by currency | 82% | 11% | 8% | -2% |

Financial expenses

Interest payments: +5.5% y-o-y to €1,015m in FY, despite debt related savings on lower debt in BRL, not offsetting extraordinary collections in 2024. The effective cost of debt related interest payments (L12M) decreased to 2.98% as of Dec-25 (Dec-24: 3.19%).

Note: For further information, please access the January – December 2025 Results Report.