- The Group posted a net income of 558 million euros from continuing operations in the first half of 2025.

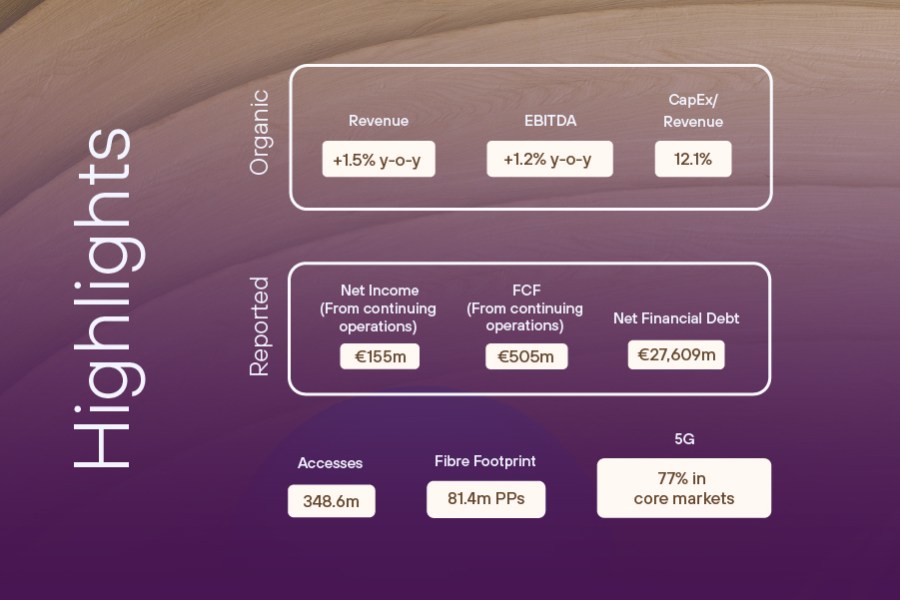

- Revenues reached €8,953 million in the second quarter and exceeded €18,000 million in the first half of the year, with organic growth of 1.5% in both periods.

- Spain and Brazil organically increased their sales by 1.9% and 7.1%, respectively, in the second quarter, and Germany’s contract mobile net adds increased 12.1% in the same period.

- Exchange rates impacted reported revenues and EBITDA, which decreased by 3.3% and 4.6%, respectively, in the first half of the year.

- Telefónica confirms the financial targets set for 2025 after the results achieved in the first half.

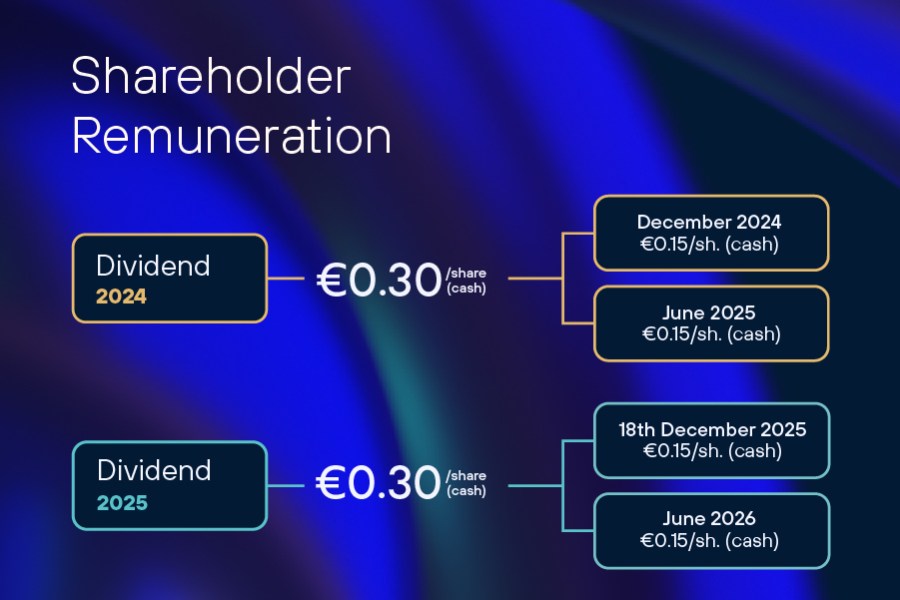

- The company confirms a cash dividend of €0.30 per share for 2025, payable in two tranches: the first next December (€0.15) and the second in June 2026 (€0.15).

- ‘We are making progress in defining our strategic review, but in the meantime, we continue executing our mandate for the year with discipline and professionalism,’ said Marc Murtra, Chairman and CEO of Telefónica.

Madrid, 30 July 2025. Telefónica today presented its financial results for the first half of 2025, which stand out for the increase in the company’s revenues and EBITDA organically and for the acceleration of growth in Spain and Brazil in the second quarter. In the first six months of the year, Telefónica has obtained a net income from continuing operations -those that are still part of the Group- of 558 million euros.

The figures achieved in the first half of the year allow the company to confirm the financial targets set for 2025, for which it expects year-on-year organic growth in revenues, EBITDA and EBITDAaL-CapEx, as well as CapEx/Sales target of less than 12.5%, cash generation similar to that of 2024 and a reduction in leverage.

Telefónica also confirms the distribution of a dividend of 0.30 euros per share in cash for 2025, payable in two tranches: the first on December 18 (0.15 euros) and the second in June 2026 (0.15 euros).

On the other hand, in the second quarter there has been significant progress in reducing exposure to Hispam following the sale of shares in Telefónica Uruguay and Telefónica Ecuador, transactions that are subject to closing conditions. These operations are in addition to those announced at the beginning of the year in Argentina and Peru, both already closed, and Colombia, which is awaiting the relevant approvals for its closure.

‘We are making progress in defining our strategic review, but in the meantime, we continue executing our mandate for the year with discipline and professionalism,’ said Marc Murtra, Chairman and CEO of Telefónica.

Consistent results

In relation to the divestments made in Hispam, the company has classified Telefónica Argentina, Telefónica del Perú, Telefónica Uruguay and Telefónica Ecuador as discontinued operations as of January 1, 2025, and has revised, for comparative purposes, the results for 2024.

Telefónica has obtained revenues of 8,953 million euros between April and June and 18,013 million euros in the first half of the year, with an organic increase of 1.5% both in the second quarter and in the first half of the year. In reported terms, and because of the variation in exchange rates, quarterly revenues have fallen by 3.7% and 3.3% up to June. By segments, B2C achieved revenues of €5,323 million in the second quarter, with organic growth of 2.1%, and B2B contributed €2,021 million, with organic growth of 5.2%. Wholesale revenues accounted for €1,609 million in the second quarter.

By markets, Telefónica España has increased its revenues by 1.9% in the second quarter and obtained its highest net customer adds since the third quarter of 2018. Telefónica Brasil has obtained a sequential improvement in its quarterly results in local currency, both in revenue (+7.1%) and EBITDA (+8.6%), which has achieved its highest growth since December 2023. And Telefónica Germany has recorded a good commercial momentum in the mobile business that has allowed it to obtain a net adds 12.1% higher than that of the first quarter of the year.

Adjusted EBITDA for the second quarter increased by 1.2% to €2,921 million, and 0.8% in the first six months of the year, to €5,867 million. Exchange rates, however, have led to a drop in reported EBITDA of 4.8% and 4.6%, respectively.

Telefónica Tech increased its revenues by 12.5% in the second quarter, to €566 million. In the first half of the year it has achieved sales of 1,074 million euros, 9.6% more.

The Group’s net income in the second quarter has registered losses of 51 million euros. This result is derived from the one corresponding to continuing operations -those that are still part of Telefónica-, which has reached a net income of 155 million euros; and that corresponding to discontinued operations -those that are no longer part of the Group, i.e. Argentina, Peru, Uruguay and Ecuador-, which has shown losses of 206 million euros. Losses for the first half of the year amounted to €1,355 million, with €558 million net income from continuing operations and losses of €1,913 million from discontinued operations.

Cash generation and investment management

The CapEx for the first six months of the year reached €2,003 million, 1.9% less than a year ago in organic terms (-6.8% reported), so that the CapEx to Sales ratio stood at 11.1%, within the target set for the whole year.

EBITDAaL-CapEx recorded €2,580 million in the first half of the year, stable in organic terms and 5.9% lower in reported terms due to the impact of exchange rates.

On the other hand, FCF reached €505 million in the second quarter, compared to -€213 million in the first quarter, closing June with a total of €291 million as a result of the usual seasonality in the first half of the year.

Net financial debt fell by 5.5% year-on-year to €27,609 million as of 30 June. Long-term financing activity reached €7,593 million in the first half of the year, which has allowed to maintain a solid liquidity position of €18,649 million, a maturity coverage of more than three years and an average debt life of 10.9 years.

Customer relevance, differential profile of infrastructures

Telefónica has ended the first half of the year with 348.6 million accesses, maintaining its infrastructures as a key differentiating element.

The company is a global leader in fibre, with more than 171 million premises passed with ultra-broadband networks, of which a total of 81.4 million are FTTH, including 29 million from Telefónica’s different fibre vehicles. Regarding 5G mobile technology, coverage in Spain reaches 94% of the population, 98% in Germany, 64% in Brazil and 78% in the United Kingdom.

Sustainability

Telefónica’s sustainability objectives, which are aligned with the UN SDGs and focus on reducing risks and delivering value, have made progress during the first half of the year. In June, Telefónica was named the second most sustainable company in the world by TIME Magazine and Statista in their ‘The World’s Most Sustainable Companies 2025’ ranking.

In terms of the environmental, the company has reinforced its commitment to achieving net zero by 2040 by updating its Climate Action Plan, which sets out a clear roadmap to reach its objectives. Furthermore, Telefónica was recognised by CDP as a Leader in Supplier Engagement for the sixth consecutive year.

On the social front, Telefónica España’s new customer service model, “Movistar por ti”, puts customers at the centre with a personalised, human and agile customer care service. advancing period “Additionally, Telefónica remains committed to diversity and inclusion, advancing LGBTIQ+ initiatives throughout the period and across its footprint. The company also continue to promote female leadership, with over a third of the executives now being women.”

On the governance side, Telefónica has been recognised for its transparency, receiving the highest award from the Haz Foundation for its fiscal transparency and an honorable mention in the Transparency Awards of the Spanish Association of Accounting & Business Administration. In addition, the company has launched an updated code of ethics and conduct course as part of mandatory training for all employees.