- Spain and Brazil consolidated their growth in the third quarter with strong commercial activity and Germany improved its profitability supported by the solid commercial momentum of its core business.

- EBITDA reached €3,071 million in the third quarter, with an organic increase of 1.2%.

Madrid, 4th November 2025. Telefónica today presented its results for the third quarter of 2025 and the first nine months of the year, which stand out for the organic increase in the company’s revenues and EBITDA and for a solid growth in Spain and Brazil.

The company’s main markets have advanced in their operations during the third quarter of the year. Telefónica España has once again presented solid commercial and financial results supported by the quality of the service, which has driven customer growth resulting in a fixed broadband accesses net gain in the quarter (+2.4%), the highest over the last nine years. This has also driven a quarterly growth in revenues (+1.6%), profitability (EBITDA, +1.1%) and operating cash flow (+3.9%). Telefónica Brasil has reinforced its market leadership with strong growth in revenues (+6.5%), EBITDA (+8.8%) and EBITDAaL-CapEx (+13.6%) in local currency. And Telefónica Germany has continued with the good commercial momentum of recent quarters and has managed to increase the EBITDAaL-CapEx margin (+0.2 p.p.) thanks to the efficiencies generated during this period.

In HispAm, the Group has continued with its divestment process. In October, the sales of Telefónica Uruguay and Telefónica Ecuador were closed, joining those of Telefónica Argentina and Telefónica del Perú. The sale of Telefónica Colombia is still pending.

Growth and profitability

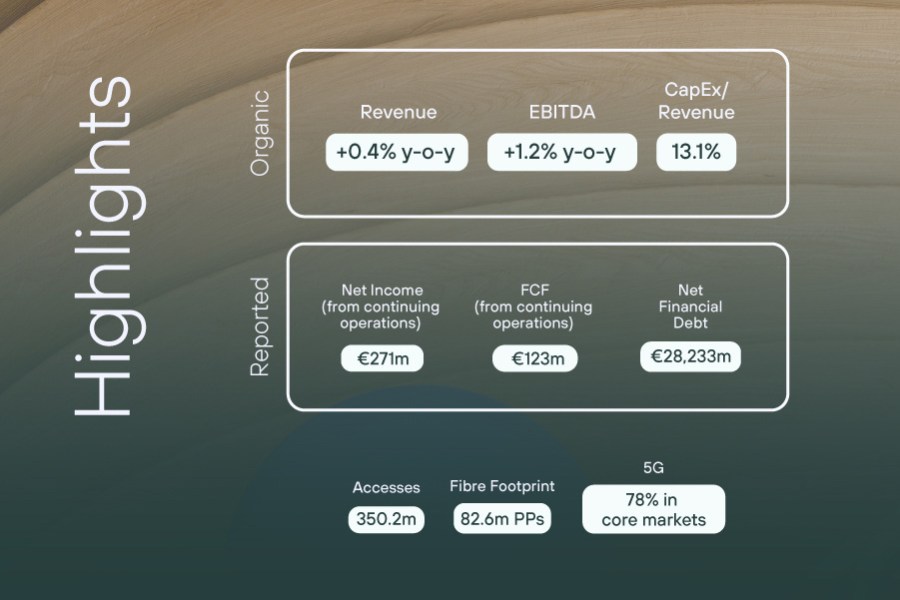

Telefónica reported revenues of €8,958 million in the third quarter and of €26,970 million up to September, with organic growth of 0.4% and 1.1%, respectively. In reported terms, and due to the impact of exchange rates, revenue fell by 1.6% in the quarter and by 2.8% through September.

EBITDA increased organically by 1.2% in the quarter, to €3,071 million, and by 0.9% in the first nine months of the year, to €8,938 million. On a reported basis, EBITDA fell by 1.5% between July and September and by 3.6% up to September.

Telefónica’s net income reached €276 million in Q3, of which €271 million came from continuing operations -those that are still part of the Group- and €5 million came from discontinued operations (Argentina, Peru, Uruguay and Ecuador). In the first nine months to date, Telefónica lost €1,080 million, with a net income of €828 million from continuing operations and with losses of €1,908 million from discontinued operations.

Telefónica has allocated €1,167 million to CapEx in Q3 (-7%) and €3,170 million in the cumulative figure up to September, bringing the CapEx-to-sales ratio for the first nine months to 11.8%. EBITDAaL-CapEx increased by 3.4% in the quarter to €1,252 million.

Free cash flow from continuing operations reached €123 million in the third quarter and €414 million through September.

Net financial debt stood at €28,233 million as of September 30.

350.2 million accesses

Telefónica closed September with 350.2 million accesses, of which 16.4 million are fibre connections, 8% more than a year ago. The company, which maintains its differential profile in telecommunications networks, leads infrastructure deployments, both in FTTH, with 82.6 million premises passed (+9%), and in 5G, thanks to a coverage of 78% in its main markets (+8 p.p.).a.