- The company starts 2025 strengthening the leadership of its core businesses and markets, with accelerated growth in Spain, above-inflation growth rates in Brazil and operational improvement in Germany.

- Quarterly revenues grew by 1.3% organically thanks to the boost from B2B (+5.4%) and B2C (+1.8%).

- The Group successfully reduced its exposure to Hispam in the quarter following the sale of its stake in Argentina and the agreement to sell its shares in Telefónica Colombia, in addition to the exit from Peru in April.

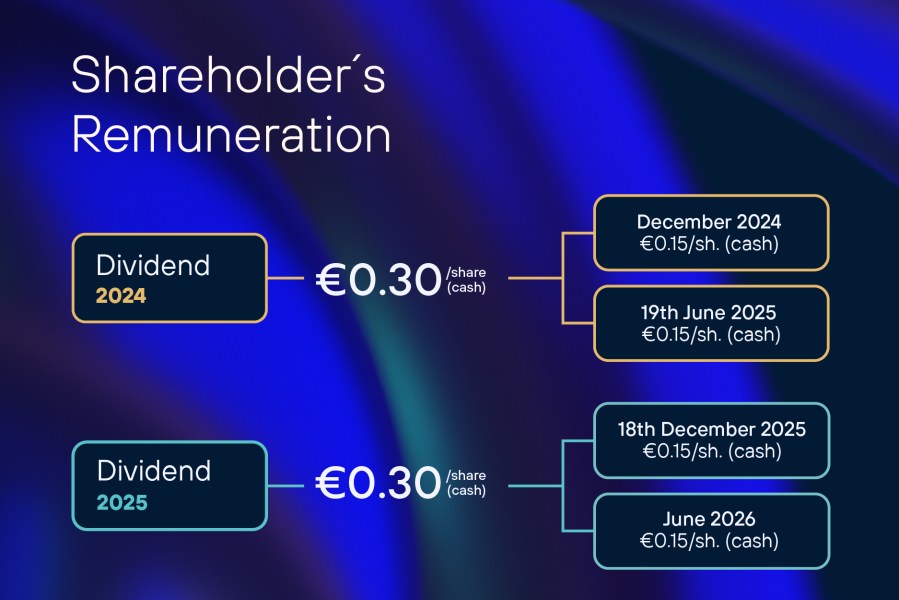

- Telefónica confirms a cash dividend of €0.30 per share for 2025, payable in two tranches: the first next December (€0.15) and the second in June 2026 (€0.15). Also, the second tranche of the dividend for 2024, also of €0.15 per share in cash, will be distributed on 19 June.

- “The results for the first quarter meet our expectations, while free cash flow reflects the usual seasonality. The Group’s results will improve throughout the year, in line with our forecasts for 2025. During the second half of the year, we will communicate the conclusions of the strategic review we are conducting,” explains Emilio Gayo, COO of Telefónica.

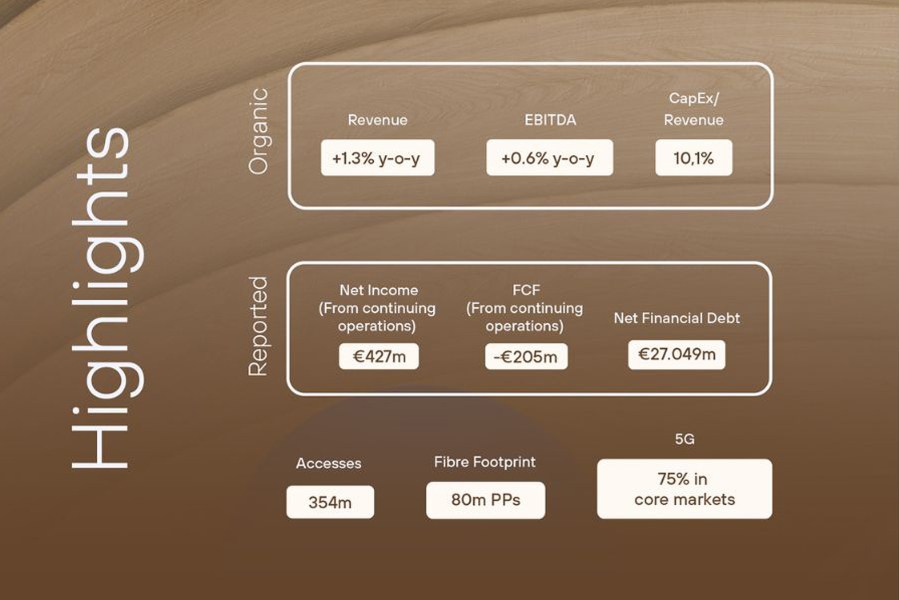

Madrid, May 14th 2025. Telefónica today presented the results for the first quarter of 2025, marked by the ratification of financial targets for the full year and the strengthening of businesses in the main markets. Net income from continuing operations – those that remain within the Group – stood at €427 million up to March. In addition, both revenues and EBITDA have grown organically in the first three months of the year.

In relation to the financial targets for 2025, Telefónica anticipates a year-on-year organic growth in revenues, EBITDA and EBITDAaL – CapEx, and sets a target for Capex/Sales to be less than 12.5%, a FCF similar to that of 2024 and a reduction in leverage.

The company also made significant progress in the execution of its plan to reduce exposure to Hispam thanks to the two operations carried out in the first quarter, the sale of the business in Argentina and the agreement to sell the stake in Telefónica Colombia, which is still pending the relevant approvals for its definitive closing. Also, the company announced the divestment of Peru last April.

“The results for the first quarter meet our expectations, while free cash flow reflects the usual seasonality. The Group’s results will improve throughout the year, in line with our forecasts for 2025. During the second half of the year, we will present the conclusions of the strategic review we are conducting,” said Emilio Gayo, COO of Telefónica.

Widespread organic growth

In relation to the divestments made in Hispam, the company has classified Telefónica Argentina and Telefónica del Perú as discontinued operations in the first quarter of 2025 and has revised, for comparative purposes, the results for 2024.

Telefónica reported organic revenue growth of 1.3% in the first quarter, to a total of €9,221 million, driven by the good performance of revenues from the B2B (+5.4%) and B2C (+1.8%) businesses. In reported terms, revenue fell by 2.9% impacted by the effect of exchange rates, which subtract 4.1 percentage points.

Adjusted EBITDA reached €3,014 million and registered an organic growth of 0.6%, although it declined by 4.2% in reported terms due to the currencies’ impact, which accounted for 4.4 percentage points.

The good performance of the core markets has led to the strengthening of leadership in the different countries. Telefónica España recorded organic revenue and EBITDA growth of 1.7% and 1%, respectively; Telefónica Brasil grew above inflation, both in revenues (+6.2%) and EBITDA (+8%); and Telefónica Germany improved in operating terms, thanks to the commercial momentum of the company, and achieved an increase in operating cash flow (EBITDAaL – CapEx) of 4.8%.

The Group’s net income for the first quarter showed a loss of 1,304 billion euros. This result is a consequence of continuing operations, i.e., businesses that remain within the Group, which achieved a result of €427 million; and discontinued operations, i.e., assets that are no longer part of Telefónica (Argentina and Peru), which suffered losses of €1,731 billion.

Efficiency and investment management

CapEx in the January-March period stood at €938 million, 2.8% less than in the first quarter of 2024 organically and 6.7% less in reported terms. As a result, the CapEx/Sales ratio stood at 10.1%.

Operating cash flow reached €1,412 million, up 0.6% in organic terms, in line with the target for the full year. In reported terms, and as a result of the currency effect, it fell by 4.9%. FCF from continuing operations showed the seasonal behavior typical of the first quarter, with a figure of -205 million euros until March.

On the other hand, net financial debt decreased by €112 million since December and stood at €27,049 million at the end of the quarter, with a leverage ratio of 2.67 times EBITDAaL. The financial activity of the quarter, which generated long-term financing of €6,780 million, allowed to maintain a liquidity position of more than €20,400 million, a maturities coverage of more than three years and an average debt life of 11.5 years.

Customer focus

Telefónica closed the first quarter with a base of 354 million accesses and a growth in FTTH and mobile contract customers of 9% and 1%, respectively. Customers are more satisfied and committed to the company, according to the NPS (Net Promoter Score) for the period, which reaches a record figure of 35 points.

In operational terms, Telefónica finished March with a total of 80 million FTTH premises passed (+13%), part of a total of 170.9 million with ultra-broadband networks. The company maintains its global leadership in fibre deployment, only behind Chinese operators. In the quarter alone, an additional 1.5 million premises were deployed, 37% of which were executed through fibre vehicles. On the other hand, the average 5G mobile coverage of the main markets has stood at 75% and has reached 92% of the population in Spain, 98% in Germany, 62% in Brazil and 77% in the United Kingdom.

Progress in sustainability

Telefónica also made progress in its sustainability objectives during the first quarter, focused on creating value.

In the environmental field, the company is hedging energy costs via renewable PPAs. With the start of supply from the PPA in Germany (for a total of approximately 350 GWh per year), the share of electricity consumption covered by PPAs will reach ~30% at Group level in 2025.

With regards to the social pillar, Telefónica continued to protect its customers, with new cybersecurity services blocking a total of 7.8 million threats to SME and retail customers in Spain. Lastly, in terms of governance, all resolutions were approved at the General Shareholders’ Meeting including the proposals relating to the ratification and appointment of Directors. The current Board of Directors is composed of 40% women and more than 53% independent members.